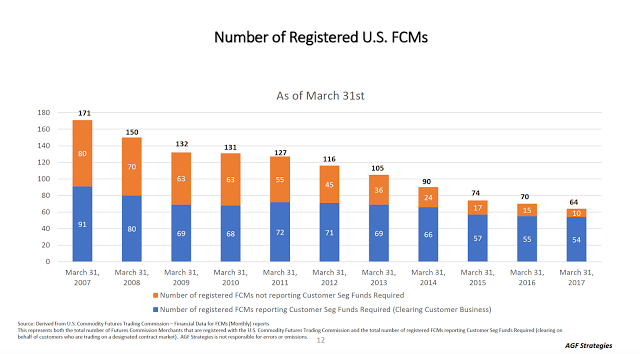

Market structure matters regardless of the industry. The interaction of economic agents will impact market behavior and drive pricing. Competition reduces markets frictions and transaction costs. If there is less competition, the cost of execution will be higher, and there will be less liquidity. This applies even to highly regulated markets like futures trading. A simple graph shows the decline in the number of FCM’s operating in the futures markets. The number has been cut in half since 2011.

To just say that more firms are always better than less is perhaps too simplistic. There can be significant competition, but it is between the top ten firms with the rest just being able to compete with less attractive prices. All we know for certain is the FCM industry is going through radical change and the number of players is falling fast. Stories tell us that smaller firms are having a more difficult time finding FCM’s, larger FCM’s are cutting less profitable clients, and if you don’t bring trading volume, you will pay a higher price even in an electronic world.

Since the Financial Crisis, regulators have increased rules in an attempt to reduce systemic risks. There have been FCM failures in the system that had to be addressed, yet regulation may have increased the cost of business and forced market consolidation. Low interest rates have also hurt the FCM community because a portion of profits comes from returns on segregated funds, albeit this is much more regulated. Technology has also added significant costs which have forced smaller players from the market. Clearing activities have become even more of a scale business. The question is how great is the impact on trading for different customer types. (Hat tip to Gary Flagler a long time futures veteran I have know from First Chicago for the graphs.)

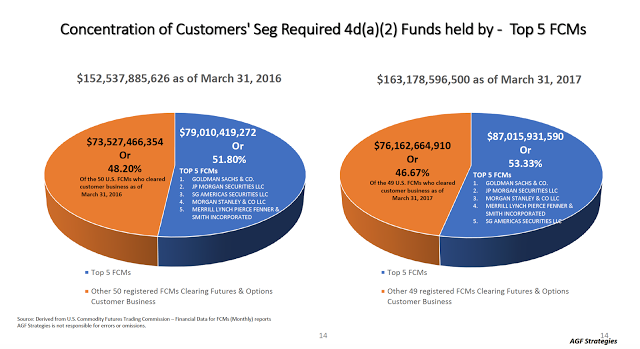

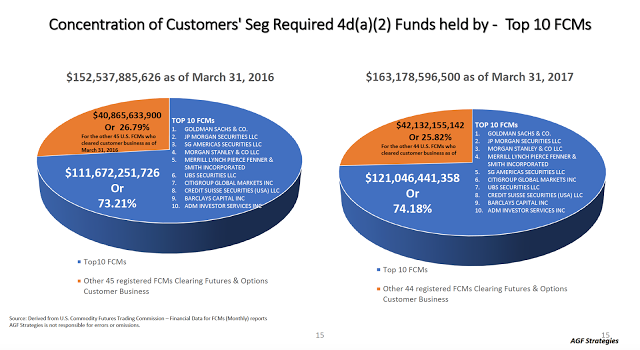

The top five FCM’s have over 50% of the clearing business as measured by seg funds. The top 10 FCM firms have just under 75% of the seg funds. Using a traditional measure of industry competition and concentration, this may be high but not a great concern. A deeper analysis is necessary to understand the closing of smaller FCM’s. Technology has made this even more of a scale business and regulation has increased the break-even business necessary to be successful. What is most interesting is that none of the top 5 and only 1 out of the top 10 FCM’s is a non-bank. Banks dominate the processing of trades and margin. This issue how scale economics affect users and their ability to access the market at attractive prices.

At the same time as the FCM’s have become more concentrated, exchanges have done the same. With a single exchange dominating futures trading in the US, the unique role of FCM’s standing between clients and different exchange margins is not necessary.

From a microeconomic view, we can discuss the costs of the firms and talk about economies of scale. This discussion is relatively straight-forward; however, what is not straightforward is the impact on smaller users. The macro or systematic risk issues are more complex and have not been truly addressed. Does higher concentration in financial markets increase systemic risk? The probability of failure for any firm may be less, but is the potential for a system failure higher? I am waiting see some careful work in this area. This work has to be done before the impact of consolidation becomes irreversible.