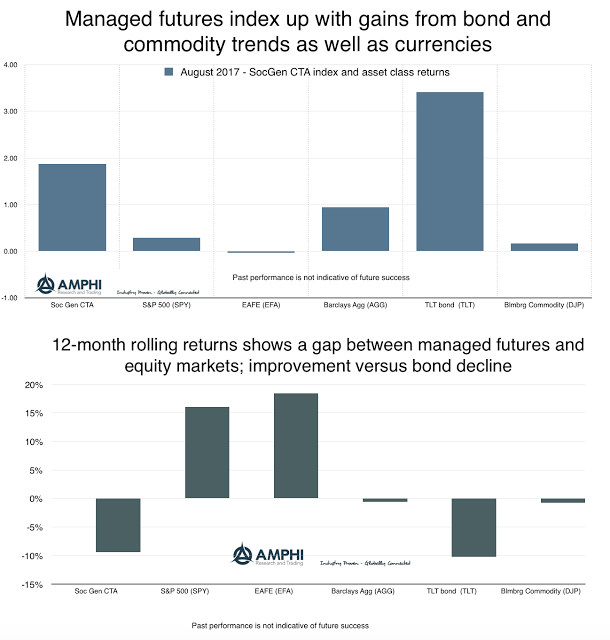

Many CTA managers posted gains for August based on strong bond moves in the US and up trends in European fixe income. Currencies continued to add to profitability albeit the decline in the dollar has a flatter slope than previous months. Gold trading was profitable for those who traded it in tandem with currencies. Equity index trading was a more difficult sector given mid-month spikes in volatility and a reversal in direction during the second half of the month. Commodity trading was mixed for many managers with profitability associated with market allocation and style of trading employed. Oil trended lower while refined products and natural gas were slightly up for the month. Hurricane Harvey volatility affected position-taking at the end of the month. Industrial metals have continued their summer upward trends which has caused renewed interest in this sector.

Managers with bond heavy allocations were stand-outs this month. There are perfect conditions for managed futures when a major market sector shows a strong trend with little volatility surrounding it. Hence, the strong gains. This was only further enhanced with currency trends that have showed similar characteristics. A core sector gain can be further enhanced through satellite positions in less liquid sectors.

September news and policy issues suggest that one of these trends may be reversed, but right now there is not likely to be significant position changes. Trends last long then expected, but extremes are often reversed and sometimes trends die of old age. This is when the quality of managers are tested.