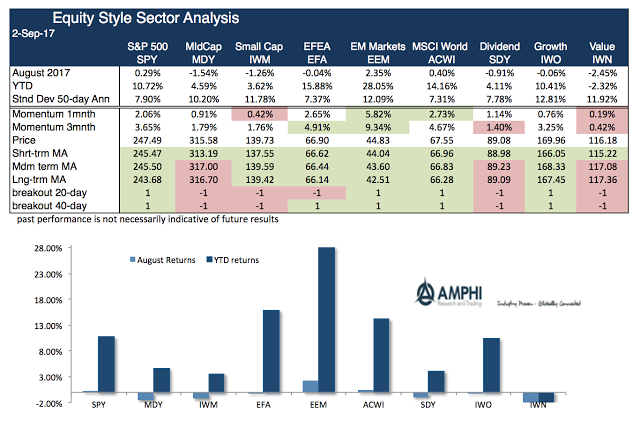

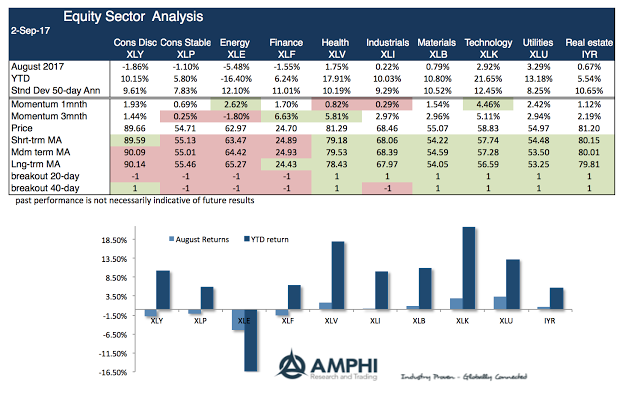

August showed growing dispersion across styles, sectors, countries, and bonds. For example, there was almost a 5% difference between holding the emerging market and value ETF’s (EEM-IWN) For sectors, there was an 8 percent differential between energy and technology (XLE – XLK) and a 3.5% difference in bonds between long-term Treasuries and high yield (TLT – HYG).

The major theme coming out of August was the mixed message of holding bonds and emerging market stocks as opposed to risky US stocks. You could think of the EM stock bond combination as a barbell around large cap US stocks. Nevertheless, these mixed messages are unlikely to continue. The pessimism embedded in bond investors versus global optimism cannot hold for long. The central bank policy meetings in September may clear up these issues.

Global equity markets, especially emerging markets, again added value to portfolios while the more domestic sensitive styles like small cap and value continue to lag. The diversification benefit of holding a global portfolio has proved to also be an excess return generator.

Sector dispersion has increased significantly which we believe will have a positive impact on active managers. The differential between energy and technology sectors is now over 35 percent. The differential between health care and finance is over 12 percent. There has been significant return value with choosing the right sector allocation.

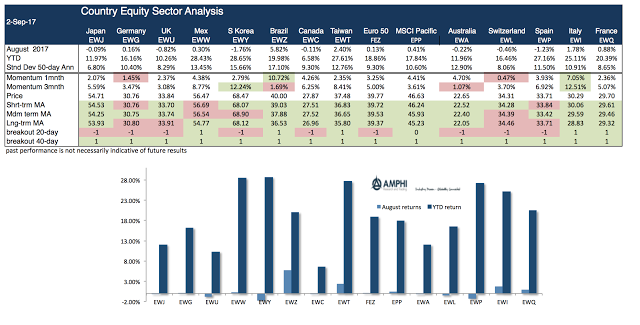

The country return differentials are also large. The returns have been benefited by currency gains. Although this month was negative, South Korea has still generated strong gains in 2017 in spite of all the geopolitical risks from North Korea.

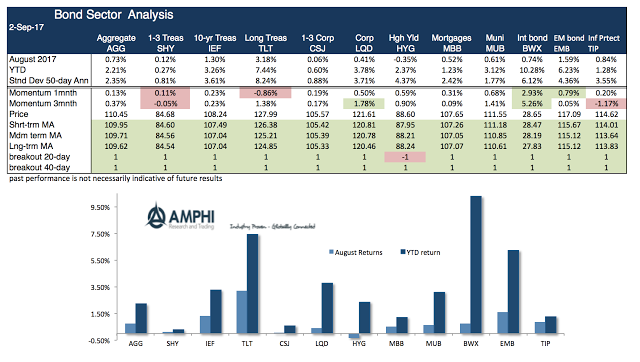

Holding duration in bonds has been a winner for the month; however, the combination of foreign duration risk with currency gains have been especially favorable for this year. High yield showed the largest underperformance for the month and has underperformed closely aligned Treasury duration portfolios.

Trend and breakout signals across a number of time scales still show value with holding country and bond risks which can be accessed in futures and ETF markets.