If you tell me I have increased equity risk, I can adjust my asset allocation way from stocks and determine a good hedge strategy. If you tell me there is more interest rate risk, I can adjust my bond exposure and determine a hedge. But, if you tell me I have geopolitical risks, the choices or options become more complex. Geopolitical risks just don’t happen often so we don’t have a lot of countable events. Increased political risks will usually mean risk-off, but how this plays-out through a portfolio is less clear. It calls for more careful portfolio construction and diversification management.

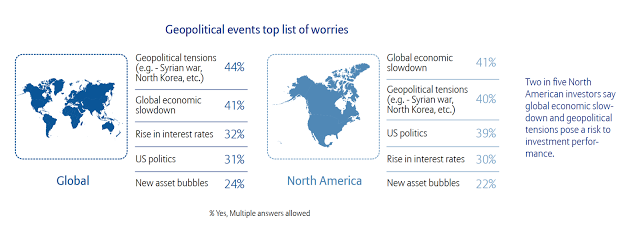

The AllianzGI Risk Monitor survey is more important this year because it highlights a change in risk concerns. With over 750 respondents around the world, this year’s survey, for the first time, places geopolitical risks at the top of the list with 40% viewing these as a concern.

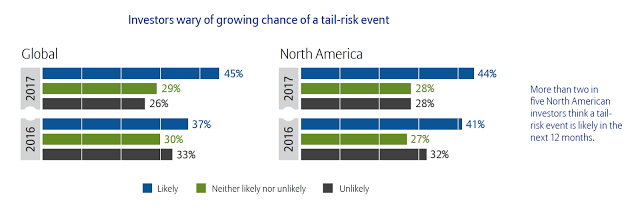

The list of worries translates into equity market and event risks topping the polls. Both increased over last year. The geopolitical risks have made investors more wary of a tail risk event which can have a major impact on performance. Tail risk worries are up over 10% since last year’s survey.

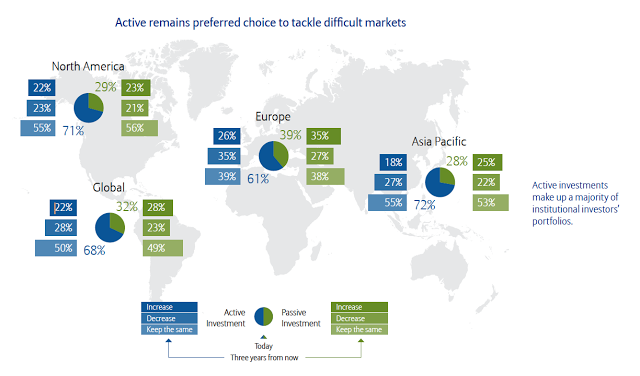

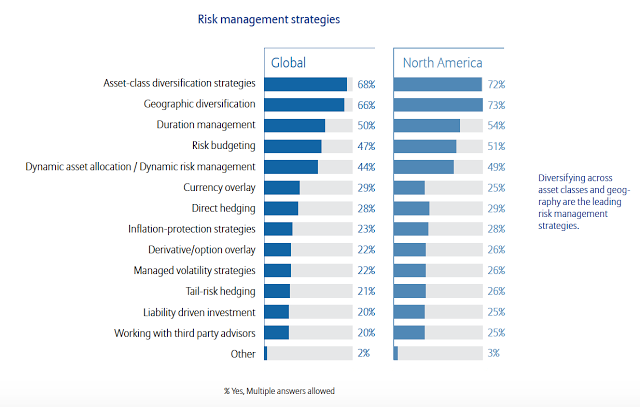

What are investors planning to do about these greater geopolitical risks? The survey suggests that there are two approaches for dealing with this market uncertainty. First, investors will continue to be active managers so options are open in order to nimbly react to change. Second, investors will continue to employ strategies to enhance diversification. When in doubt, hold a broad basket of asset classes and strategies that can be adjusted as needed.

What applies to the portfolio overall also applies to alternative investments. The survey emphasizes the important role of diversification from hedge funds. In an uncertain world, strategies that help maximize diversification should be in high demand. Global macro and managed futures fit this profile. These strategies have low overall diversification because they actively trade many asset classes. Additionally, managed futures has shown to generate crisis alpha or a crisis risk offset which will be extremely helpful if there is a geopolitical event that creates strong tail risks.