Diversification can come in many forms. One that is not often discussed is holding period diversification or the time- frame used for making a trading decision. Some strategies are successful based on the expected holding period of the investment and not just the trading process employed. For example, there could be two price-based systematic managers who use similar models, yet they will get very different returns based the calibration of the holding period, short-term versus long-term. In the case of trend-followers, there are some trends that last only a short-time and can only be captured through trading a short time-frame versus other trends that can last for weeks, months, or quarters. These are captured differently based on the look-back or speed of the models.

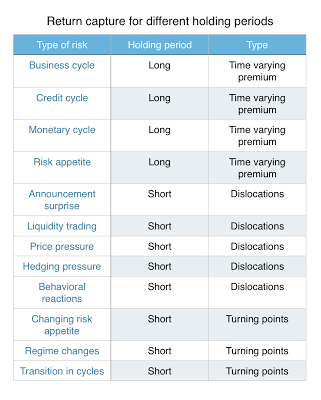

Trend-following managers will often use models with different look-back periods to add diversification by capturing different market reaction speeds to different shocks or events. Longer-term models will often pick-up time varying risk premiums associated with the business, credit, and monetary cycles. Shorter-term faster models will capture announcement shocks which generate transitions to new equilibrium. These fast models are trying to capture dislocations in liquidity from imbalances between buyers and sellers.

Many systematic managers explicitly mix time-frames or holding periods to smooth return patterns. Investors can do the same thing through choosing managers that have different return holding period focus. A long-term trend-flooder can be matched with a short-term trader so an investor can capture price trends associated with risk premiums and with market shocks. Low volatility may provide strong signal to noise for longer-term trend identification while higher volatility may allow for more dislocation opportunities for shorter-term traders. Trading style and time diversification is one of the easiest methods for return smoothing within the hedge fund strategy space.