Along with any discussion of asset bubbles, there is a complementary discussion concerning tail risk. If there is a bubble, there is likely to be a tail in the future. Bubbles and tails are tied together, yet tail events can occur even if there is no bubble.

Tail events are driven by unexpected regime changes that cause a significant change in investor expectations and capital flows. The tail is created by a surprise loss that feeds into a feedback loop of selling and uncertainty. A tail risk is fundamental for any risk management discussion. Nevertheless, our ability to predict tail events is poor. My qualitative view is that no tail event has ever been effectively predicted by the majority of fund managers. Investors often try to describe the next tail event but by their nature, these events are surprises.

Just because these are low probability events does not mean they will not have an impact on prices. Changes in probabilities for these tail events will impact expected returns. What is more useful is the expected chance of a tail event, not the identification of the event, but we can get that from option prices through the smile.

-From Cullen Roche

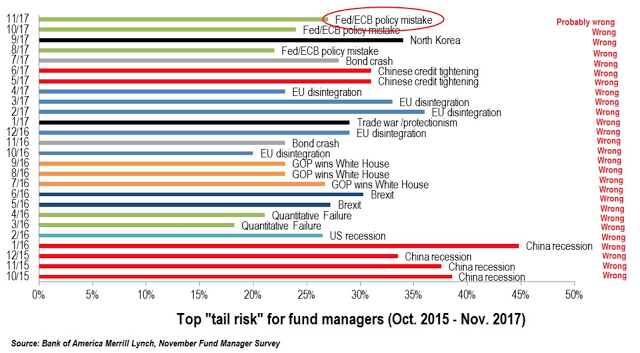

The Bank of America Merrill Lynch chart shows the top tail risks identified by fund managers each month over the last two years. What is interesting is that there is an ebb and flow on the likely tail event each month. Since tail risks are low probability events, it is likely we will get these events wrong. The market may have predicted a GOP win as a tail event, but it is less likely managers were in agreement that this would be a positive right tail event.

The most critical action for fund managers is not identification of a tail event but the diversification response to a possible tail event. The tail events listed are global and affect many markets. A single risk management approach like protection through put options will not do.

The portfolio diversification necessary is through strategies that can go both long and short and can be event classification agnostic. From our view the strategy that will be most effective is systematic trend-following. There is no need for identifying the event. There is no need to pick the probability of the event. There is no need to locate the markets that will be affected.

Price action through trends will tell the systematic manager what to do; buy markets that are rising and short those that are falling, and if you are on the wrong side of the trade have stop-loses take you out of positions. This non-predictive approach is an easier more direct method to solving any tail problem.