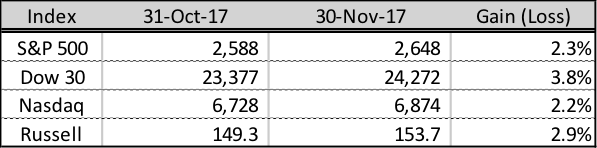

John F. Kennedy’s aphorism “a rising tide lifts all boats” seems to be particularly appropriate when describing the results of both the domestic and international equity markets these past 30 days. The benchmark indexes performance for the past month have been as follows:

Not only are these great numbers but consider that the volatility index (VIX) broke through 13 only once during the month on November 15th. While we certainly are thankful for the gifts this extended bull market continues to bestow on us, it is important to keep in mind that valuations at these levels are arguably stretched. As a result, we need to trade with the understanding that some degree of a modest correction is probably in our not so distant future. Nevertheless, December is statistically one of the strongest months for equity growth, and consequently, we do not want to spend the month on the sidelines. Our strategy for December will be aggressive but with a greater than normal amount of caution and downside bear protection.

At its core, the Managed Beta trading strategy buys on market weakness and sells on market strength. This strategy is difficult to implement when the equity markets provide only strength. The S&P closed 1.15% off the trailing high once in the month (Nov. 15th). There were two other days when inter-day the S&P dropped below 1% (Nov. 9 & Nov. 13), but on both those days, the index rallied strongly before it closed. There was not much opportunity to trade a variable beta strategy this last month.

Russell Index: As we entered November, the US Congress was executing a full-court press to finish up a new tax bill that could be passed before the end of the year. Now that a draft of such a bill has passed both the house and the Senate, it is reasonable to expect a compromise will be signed by the President before the year is out. We expect that small caps, with their significant exposure to the US domestic market, will ultimately outperform the multi-national large caps when/if this new tax bill makes it through the legislative process. Additionally, as the Fed continues its march to normalize interest rates, the Russell index, with significant exposure to banks, should experience a better than average benefit from an increase in rates. Finally, In December, we plan to continue our buy and hold strategy for the Russell.

Nasdaq Index: Tech stocks continue their amazing run. Year to date, the index is up 27.7% which begs the question of whether these stocks have become so overvalued that a significant correction is inevitable? The Nasdaq poster child is Amazon, up 57% since the beginning of the year. With that growth, one should keep in mind that 2016 was the first year that Amazon put any significant black ink to the company’s bottom-line; looking forward, the EPS growth consensus is 4.24 (Dec. 2017) to 29.32 (Dec. 2020). Does anyone expect Amazon will not achieve these numbers? While Amazon certainly will continue to be volatile for the next several years, it is certainly realistic to expect that Amazon will continue to grow its market cap. Facebook is an even more amazing story. After a 54% YTD increase in stock price, Facebook’s growth has not kept track with the company’s earnings growth. At this point, Facebook is less expensive today (based on straight PE) than it was this time last year. More important, stocks that make up the Nasdaq have the highest potential for growth as the world’s macroeconomic engine continues to explode forward. Short of a nuclear war with North Korea, there is not much on the horizon which should slow down the earnings growth of the Nasdaq tech companies. In December we plan to continue our buy and hold strategy for the Nasdaq.

S&P 500 and Dow 30 Indexes: The S&P bolted up 1.77% in the last 5 trading days ending the month with an overall gain of 2.3%. The S&P, together with the Dow, are the two indexes that give me cause for concern. The market value for many of the companies that dominate these indexes seems to have run ahead of themselves. That is not to say the indexes do not have room to run further, but rather, as we trade these indexes we need to be particularly cautious of a protracted pull back. Trading the dips of the S&P or Dow is the bread and butter of the Managed Beta trading system, but those buys only work if/when the index recovers and does not continue to collapse. For December, we will buy on dips, sell on strength and hold a meaningful amount of downside insurance protection in the form of bear spreads.

We anticipate spending between $600-$800 for every $250,000 (notionalized) on bear spread insurance during December. This is approximately 20% of the average monthly profit generated by the Managed Beta trading system.

Note: Considering the recent abnormally calm market conditions I would like to remind investors that they should mentally be prepared for a 10-12% drawdown in the Managed Beta system. Returns are a function of risk and volatility. From a purely theoretical perspective, the more volatile we can shove into the day to day returns, the greater the annual portfolio return should be. The fundamental objective of the Managed Beta trading system is to have protection against downside drift and left tail risk while localizing the day to day volatility around the origin. While Rincon recommends trading Managed Beta alongside other CTAs, in a well-diversified portfolio, it is strongly recommended that an investor not leverage the Managed Beta system above 2:1 and careful examine correlated exposure with other CTAs such as the downside risk inherent CTAs’ selling S&P put option.

Authored by Eric K Thompson