The general view is that an investor should pick good managers who have had a track record of success, but a more nuance look at data suggests that buying when good managers underperform can be valuable. Whether past performance provides some indication on future success has been one of the key issues facing any investor. We now have an interesting perspective from Brad Cornell, Jason Hsu, and David Nanigian in their Journal of Portfolio Management paper, “Does Past Performance Matter in Investment Management Success”.

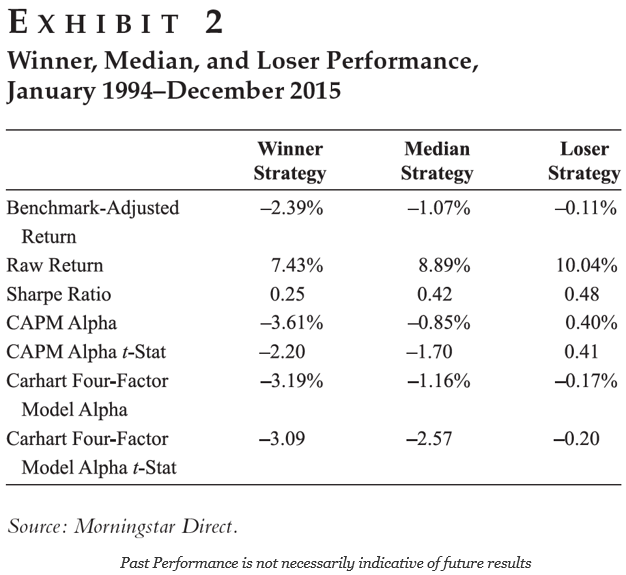

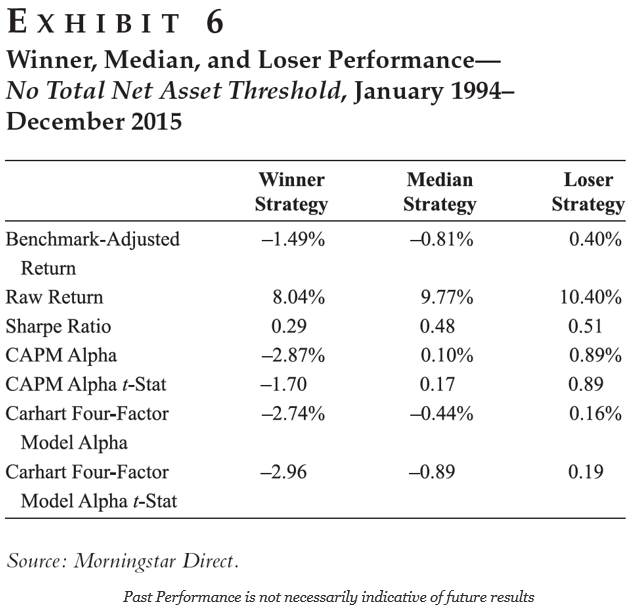

The authors followed a simple rule that is consistent with the behavior of many investors. They looked at the previous three-year returns and then buckets the performance into winners and losers. They then tracked the performance over the next 36 months relative to a benchmark. What they found may surprise many investors.

The losers did better than the winners. Hence, a switching strategy of selling losers and holding winners may actually lead to poorer performance. Now a consultant or advisor who advocates looking to increase allocations to losers may be viewed as crazy, but the data make a compelling case that an “off with their heads” approach to poor performance is financially dangerous.

The reason for this mean reversion is still not completely clear, but the flow of money into winners may affect performance is a leading candidate. Herding hurts the future performance of past since new money flow dilutes limited alpha.

So what should be the key take-away from this research? Do your homework and make your judgments on manager allocations through criteria that look beyond performance. The authors suggest some criteria focus by other researcher such as: fund manager compensation, fund manager ownership and commitment of capital, a high active share, outsourcing of non-investment services, having PhDs in key portfolio roles, and a strong positive firm culture.

Some preliminary evidence suggests that this same behavior applies to hedge funds within the managed futures and global macro space. Our view is that performance is one measure of success, but it should not be the definitive criteria for any allocation decision. Know your manager beyond the numbers.