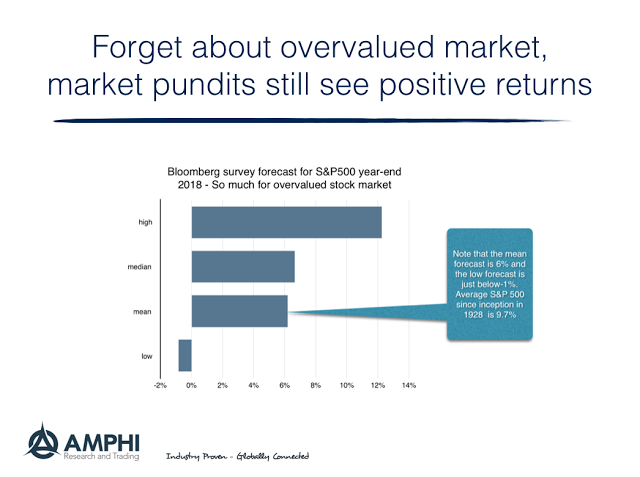

Perhaps the market analysts making 2018 forecasts for the S&P500 did not get the memo on valuation. The equity markets are overvalued by most any measure, yet the median forecast is still expecting a 6% total return in the year-end Bloomberg survey.

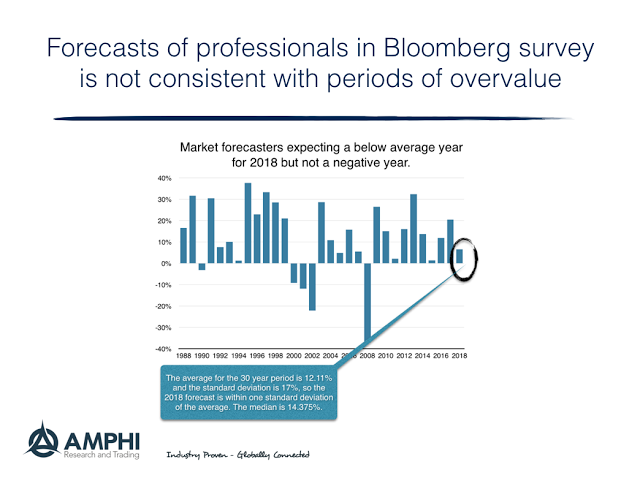

In context, the unconditional mean return for the S&P 500 since inception is 9.7%. For the last 30 years, the average return is 12%. Hence, the median for 2018 is about half of the shorter-term average and 1/3 less than all time averages. Clearly analysts are not expecting 2018 to be an average year.

However, if we look at the periods when the market was significantly overvalued like 2000 and 2008, the conditional forecasts suggest that this 6% forecast is very optimistic.

The composition of the S&P 500 has changed significantly over its lifetime and dividends provide a good cushion for returns, but these 2018 forecast numbers seem aggressive.

For an investor who wants to bet against the consensus, the first line of defense is diversification across assets classes and investment styles. Additionally, downside protection can be generated through the use of option strategies that protect against any worst-case scenario.

A significant part of investing is always about competing against market consensus. So, do you believe the consensus?