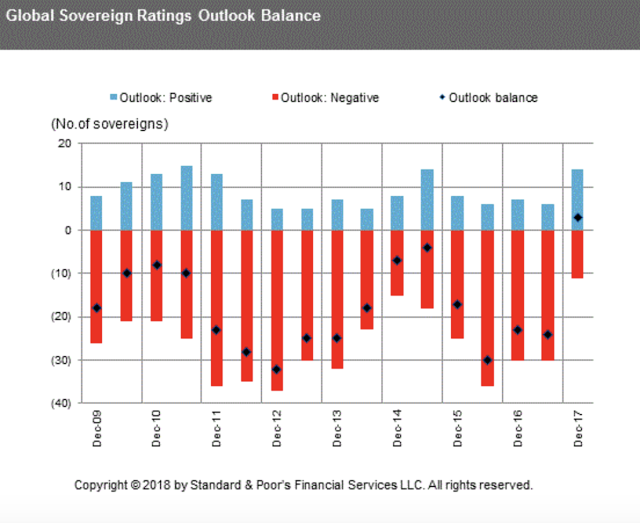

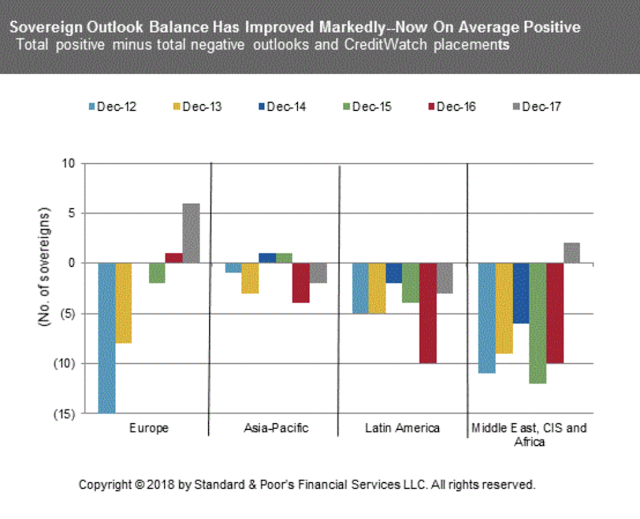

A year ago the market was concerned about global credit risks. The sovereigns with a negative outlook were high and the number of positive outlooks was low, but that has changed in one year given the improvement in global growth. The number of negative outlooks is at post Financial Crisis lows, the positive outlooks are high and the balanced outlooks are positive for the first time. The balance has improved markedly across regions but especially in Europe and the Middle East. The chance of default risks has fallen given credit quality is improving.

Nevertheless, the pricing of credit is still tight. The upside potential for spread widening relative to spread tightening is still high, but investors may have to wait for the credit-widening event. With growth strong, risk-on sentiment still high, and credit/liquidity not biting into behavior, there still is a reason to hold credit exposures. Carry-on.