There has been a consistent drumbeat that investors should use hedge funds as a core means of portfolio diversification. This has been at the expense of other methods of hedging. A diversification strategy makes sense when there is no investor information advantage or no view on the direction of markets, but in reality, investors often have some view on market direction or risks at the extreme. However, given the uncertainty on market direction and the inability to form conditional hedges, the investor focus is usually on strategy diversification through hedge funds.

Nevertheless, option strategies can be effective alternatives to hedge funds especially if there is a market view. We mention the issue of market view because low cost option strategies will often buy puts to protect a percentage of the portfolio or protect against a specific sized move and selling calls is used to generate premium to pay for the puts. The call selling is based on either a market view or a willingness to limit upside.

There is a close link between hedge fund pay-offs and option pay-offs. A number of researchers have used options pay-offs to describe hedge fund returns. For example, managed futures have often been described as being long a straddle. Some relative value strategies have been described as being short options. Given this link between the non-linear pay-off of options and hedge fund strategies, it would seem natural to compare the two to see which actually perform better when equalized on volatility or market exposure.

On the one hand, investors access the skill of the hedge fund manager versus the direct pay-off from options which do not include all the fees associated with a hedge fund. Given that option should be cheaper, a simple question is whether hedge fund skill can cover their costs and also outperform an option strategy.

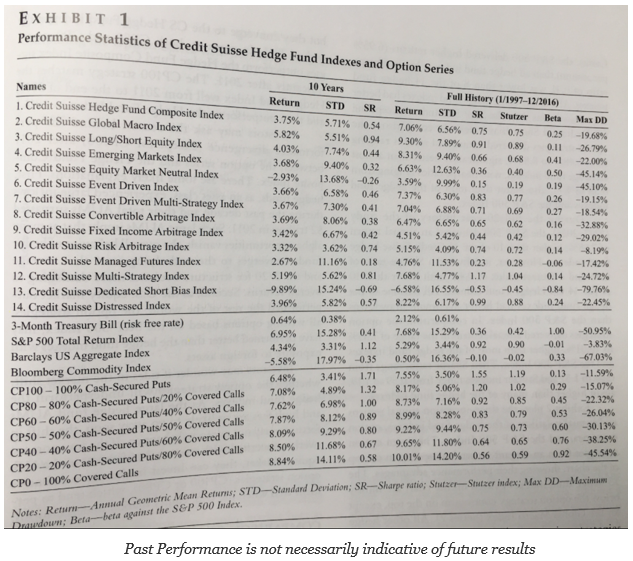

We think this work has been under-researched, yet that is changing with a recent paper in the Journal of Alternative Investments. (See “alternatives to Alternative Assets: Assessing S&P 500 Index Option Strategies as Hedge Fund Replacements” by Wei Ge.) The author compares seven different option strategies on an equity index against 14 different Credit Suisse hedge fund indices that cover all of the major hedge fund strategies. The comparison is done through either beta volatility matching.

The results show that the combined option strategies of buying puts and selling calls against the index generated higher returns and have better return to risk characteristics. The numbers are economically significant and should be persuasive even to motivate any investor to take a closer look at the value of these strategies as a hedge fund alternative.

There are a host of management issues with trying to implement options strategies as well as regulatory barriers, but all of these can be effectively addressed. Why limit diversification alternatives to hedge funds when there are option strategies that can provide better choices?