What is the most fundamental lesson learned for investors from the Financial Crisis of 2008? It is simple and in the name. We don’t call 2008 the Great Recession. We call it the Financial Crisis. Financial conditions matter more than what we have thought in the past. If money and credit is the oil that runs the engine of commerce, then financial conditions measure the efficiency of the wiring.

Financial conditions impact all markets. When there is a breakdown in the financial environment, credit will not properly flow to those that need it. A break in financial conditions will change the willingness of financial institutions to lend and the confidence of firms and consumers to borrow. There are real effects from changes in financial conditions, but investors and consumer react to finance conditions by either being more optimistic or pessimistic on growth or returns on investment. This change in sentiment affects financial prices.

Hence, financial conditions should be monitored to track potential changes in economic growth and the value of assets. This emphasis on financial conditions is now a focus of macro research, and global macro investors should follow them closely. Financial condition indices (FCIs) use information from a wide set of financial variables to measure risk-taking and possible financial frictions. Wall Street firms, Federal Reserve Banks, other central banks, and the IMF have developed FCIs. The indices provide insight on whether markets are in a risk-on or risk-off environment. Risk-on/risk-off (RORO) regimes are another way of measuring global sentiment through fundamental factors.

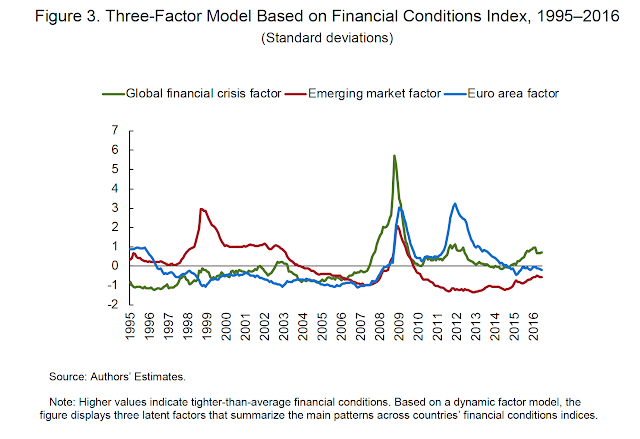

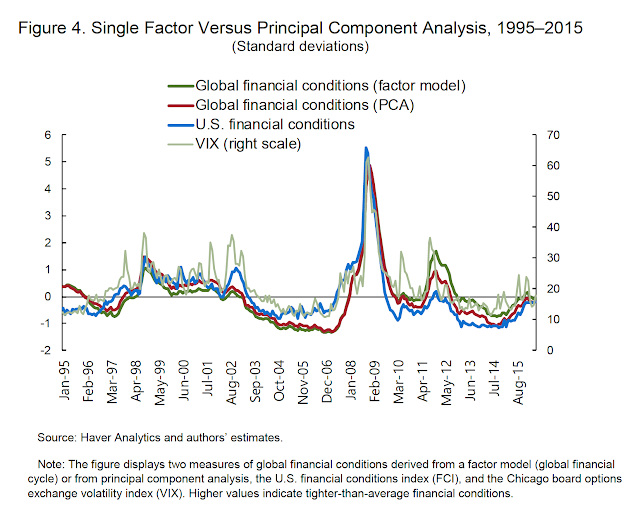

Recent research, (see “Can countries manage their financial conditions amid globalization” IMF Working Paper, WP/18/15) has focused on the impact of global and local financial conditions on different economics. The authors look at 10 financial indicators including: corporate spreads, term spreads, interbank spreads, sovereign spreads, change in long-term rates, equity and housing price returns, equity volatility, credit growth, and financial market share. Their analysis looks at both global and local financial conditions across a broad settlement of countries.

Their evidence suggests that common global financial conditions have a meaningful effect on the financial conditions of local economies, between 20% to 40%. The global financial conditions are closely tied to US financial conditions and global risk factors like the VIX index. Still, local financial conditions are different across countries so following each country’s conditions is useful.

If you want to avoid country specific macro risks, track global financial conditions as well as local conditions. If these conditions start to turn negative there is a clear signal that financial sentiment is changing. What still needs to be done, is measuring the link between the level and change in financial conditions with future market returns. An extreme move is a clear signal, but the sensitivity between financial conditions and performance still needs further documentation.