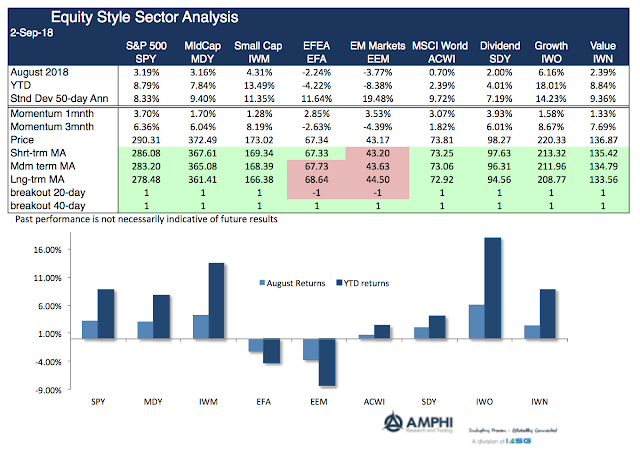

Call it the pain of international diversification for 2018. With a significant divergence between US and international equities, the cost with holding DM and EM stocks has been significant. The differential between EM and US growth indices is over 25%. August just added to this different with fears of sudden stops in risky EM countries. Turkey and Argentina have both showed that credit flows can change quickly in a sensitive macro environment.

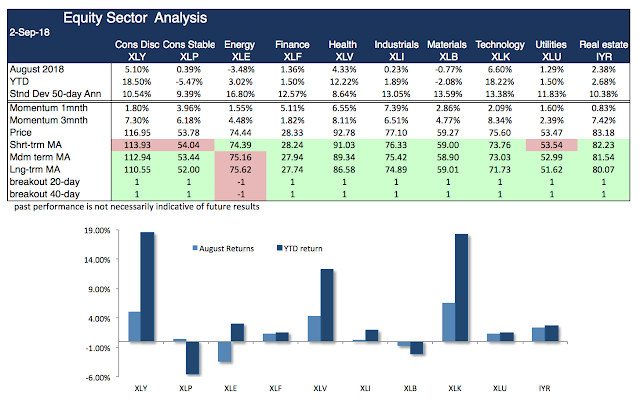

The sector analysis shows continued strength in technology, health and consumer discretionary sectors. The health and technology gains are theme-rated while consumer discretionary pinpoints the strong economic growth of 2018. All sectors point to further gains except for the energy sector.

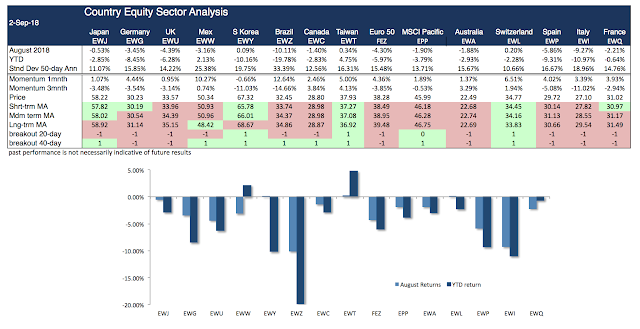

Sovereign country ETFs show the global fears gripping equity investors. Weaker macro environments saw continued sell-off in August. Investors are taking a closer look at leverage and underlying economic structures in EM markets.

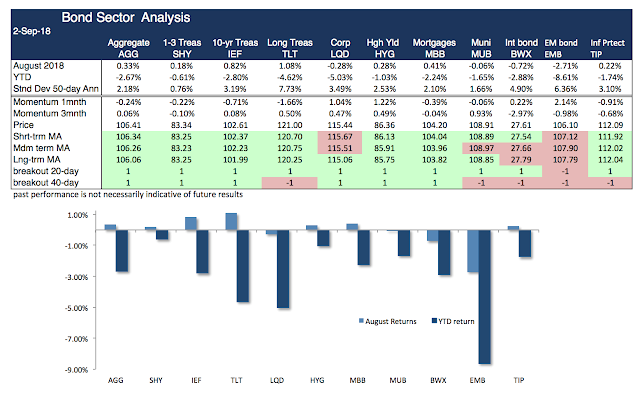

Bond market performance was generally consistent with a strong risk-on investment environment for 2018, but Treasuries gained in August based on global flight to quality. International and EM bonds showed continued weakness based on the strong dollar.

Trend and breakout analysis suggests a long focus on US style ETF’s and continued avoidance of DM and EM equity investments. Sector bets focus on economic growth and technology. Avoid risky sovereigns and accept that while bonds may do better on flight to quality, they will reflect the strong risk-on US environment.