There are now hundreds of alternative risk premia that are available from banks. This is a business outgrowth of the alternative risk premia work that has been done by academics. Yet, it is difficult to argue that there is any one return or risk profit that can describe the performance of risk premia. There are structural risk premiums which may not vary much over time and as well as risk premia that are cyclical in nature and be related to macro economic factors.

What is clear is that investor can blend risk premia to provide enhanced return to risk because these premia are often uncorrelated given their unique features. While the styles of risk premia may be the same, the behavior across asset classes is very different.

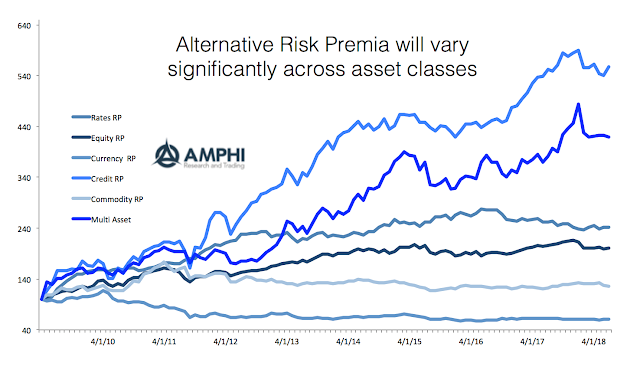

The HFR Bank Systematic Alternative Risk Premia Indices can be used as indicative measures of the differences across asset classes. These asset class indices include, value, carry, momentum, and volatility ARP’s. The return evidence from these indices shows significantly differences in performance.

There may be some concerns on the representativeness of these bank systematic ARP indices based on the institutions that have contributed to HFR, but we believe that we can glean some useful information on cross-asset performance.

Credit has done especially well during the post financial crisis periods given the strong tightening of spreads over the last ten years. This asset class ARP index outperformed all other asset classes. The combination of strong capital inflows and the improvement of the firm finances allowed for strong gains across a number of risk premia.

Alternatively, currency risk premia have fared poorly during this period based on the range bound behavior of interest rates, economic growth, and monetary policy across countries. Low variations in fundamentals have meant that ARP opportunities have also been limited. To a lesser degree a similar phenomena occurred in commodities that have been in an extended drawdown, albeit our analysis suggests that properly funding the right ARPs can generate strong returns.

For equities, there has been a stable return profile when weighing these risk premia although the patterns have not matched a pure market beta approach to risk. The performance for rates APRs has fallen with the flattening of yields curves across many countries. There has been less term premium and roll to exploit in the current environment.

Most notable has been the strong albeit more volatile performance of the multi-asset index that shows the strong benefit of bundling a portfolio of ARP across all asset classes. The low correlation across asset class ARPs means that the diversification benefits of picking risk across all asset classes is helpful.

We have been surprised by the large return dispersion across APRs across banks. Since there is no one agreed upon definition for any ARP, there should not be the assumption that style APRs will be alike. This means that actual performance for an active APR portfolio may differ significantly from any index. Still, the relative evidence suggest that alternative risk premia across asset classes are not alike.