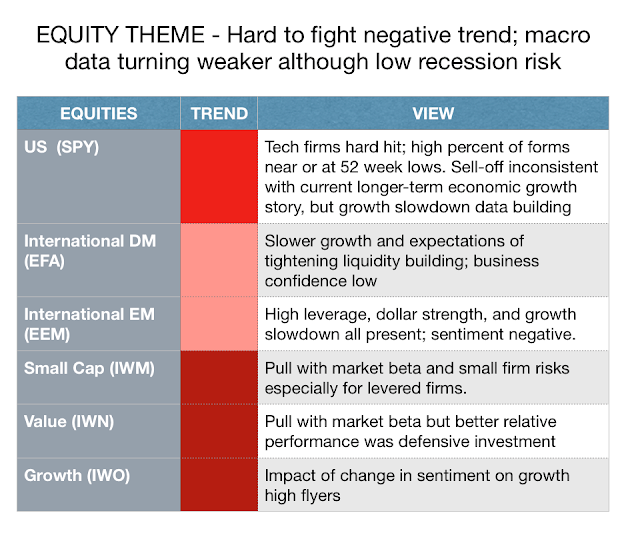

It not a matter of like or dislike the fundamentals of equities in the current environment. When sentiment changes and volatility increases, reassessment of current exposures is warranted. However, concern about the macro environment should be increasing. Maintaining lower market risk exposure by more than half of core allocation from 60% to 30% or half equity beta exposure is appropriate. (The darker red signifies a stronger trend.)

Growth – While recession risks are still limited by any probability-based model, economic growth will be tempered in 2019 both in the US and rest of world. Earnings have not yet been significantly affected by growth, but forward expectations are now slightly biased downward.

Liquidity – Continued Fed tightening and expectations of tightening around the rest of the world serve as a negative for fixed income. High rates are starting to impact higher levered firms and lending. Make no mistake this is what central banks want.

Risk Appetite – Higher volatility with changes in sentiment suggest market is moving to risk-off environment. Financial condition trends are pointed lower. With risk-off, harder to buy on dips so more downside follow-through.

Structural – Gridlock in government will negatively affect further tax reform and regulatory changes. Fiscal deficit is now pro-cyclical which will further affect rates.

Technical – There have been some key periods of divergence between equity style sectors. International and EM have actually been a place to hide in the near-term

Looking over year-to-date, six-month, and three-month returns shows three distinct differences: The divergence between US and rest of world, the dislocation between large-cap and value, growth, and small cap equities, and the reversal of the earlier international underperformance.