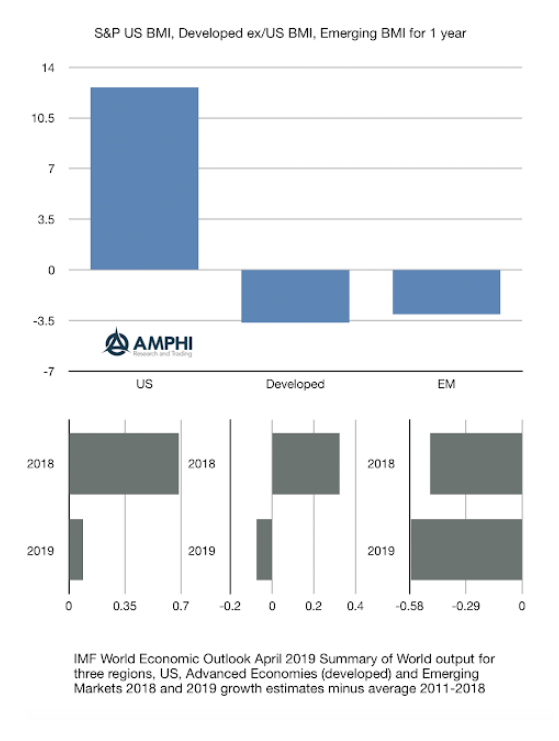

While some question the rationality of markets over the last few quarters, we believe equity markets are global macro consistent. This consistency can be seen in the return pattern for the US, developed markets, and emerging markets. As a simple surprise number, looked at the difference between the average growth rates for three macro categories from the IMF WEO from 2011-2018 against 2018 growth and expected 2019 growth.

US growth has been above average. Advanced economy growth is expected to be below trend switching from above the trend rate in 2018. Emerging markets will continue to be below trend. Obviously, future returns will be balanced by future growth expectation, but the current situation feels consistent with the deviations from growth trends.

Global Macro Rationality and Equity Returns – Consistent With Growth Story