Commentary by AG Capital Management Partners, LP

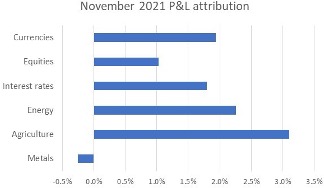

The Discretionary Global Macro Program generated a 9.3% return, net of fees, in November 2021, leaving YTD performance at -1.4%.

Too late

Although the Omicron variant of coronavirus is capturing current headlines, it’s not top of the list of things we care about from a macro perspective. Instead, a more relevant topic is the Fed’s continued hawkish shift, in the face of what we view as a momentous and rapidly approaching slowdown in the global economy.

Fed Chairman Jerome Powell’s recent decision to retire the word “transitory” when describing inflation may go down as the bell that no one ever hears ringing at the top of a bull market. The Fed is a political creature, and Powell’s timing strikes us as bizarre – he either should have begun the tapering process ten months ago, when all sorts of stocks were bubbling, and growth was screaming higher due to the massive fiscal stimulus; or, he should have stuck to his guns regarding “transitory” inflation (which we largely agree with).

Instead, a string of continued high inflation readings has embarrassed the Fed and all but forced them to cave in to pressure to focus on inflation (which most Americans have already done given Biden’s plummeting approval rating), putting their other mandate of unemployment on the back burner.

The Fed now appears to be on autopilot with regard to continued tapering, and the question is whether they will increase the rate of their tapering at the upcoming mid-December FOMC meeting. This is happening while:

- Emerging market growth continues to slow dramatically, led by China’s decision to rebalance its economy from a fixed investment (construction-driven) model to one based on consumption. Although this will take years to play out, the key takeaway is that China will not stimulate its economy as it did during the aftermath of the 2008 GFC and during every growth scare in the decade since.

- Equity breadth underlying U.S. indices has become downright terrible, just as it did during 2000, as investors rotate into the largest tech growth stocks. Most stocks peaked earlier this year and are down double digits. The technical patterns on various stock index futures look like tops to us, with signs of institutional distribution to retail hands, just as what occurred during the top of the market in 2000.

- Commodities have likely topped as well. Crude oil is trading in the low $70s, despite Goldman Sachs and every other bank calling for crude in the $90s and above due to lack of supply from OPEC and U.S. shale (apparently, they forgot about the demand side of the market). It’s much easier to look smart by modeling rig counts and the lack of spare capacity at OPEC; demand is usually a plug in their models and is expected to just “grow”.

- U.S dollar liquidity continues to tighten based on the Fed’s actions – a glance at a chart of the dollar index or the euro corroborates this.

We truly believe that Powell wanted to do everything possible to avoid a repeat of Q4 2018 when he was forced to quickly walk back from a pre-determined tightening path due to the temper tantrum that markets threw all quarter. But, unfortunately, the political climate in Q4 2021 may have forced his hand at the worst possible time as we head into a global growth earnings slowdown and a possible recession.

Current portfolio

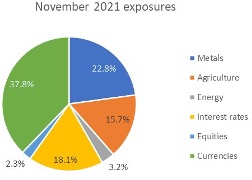

Sometimes, we change our portfolio drastically quarter-to-quarter, and other times, the right thing to do is sit tight – this feels like the latter. We continue to be positioned short commodities, long bonds, long the U.S. dollar, and short equities. Our conviction in these positions has increased in recent weeks.