Archives

The U.S. Dollar and the Emerging Markets

Historically, periods of USD appreciation have led to outflows of investment dollars resulting in economic hardship, crisis and even regime change in emerging market nations. The 1997-1998 Asian crisis, the related default of Russia and the collapse of the hedge fund Long Term Capital Management, for instance, were precipitated by a strong USD and a rapid reversal of capital flows from Asia back to the U.S. It is estimated the crisis resulted in the repatriation of $250-$500 billion.

The USD Role as a Funding Currency

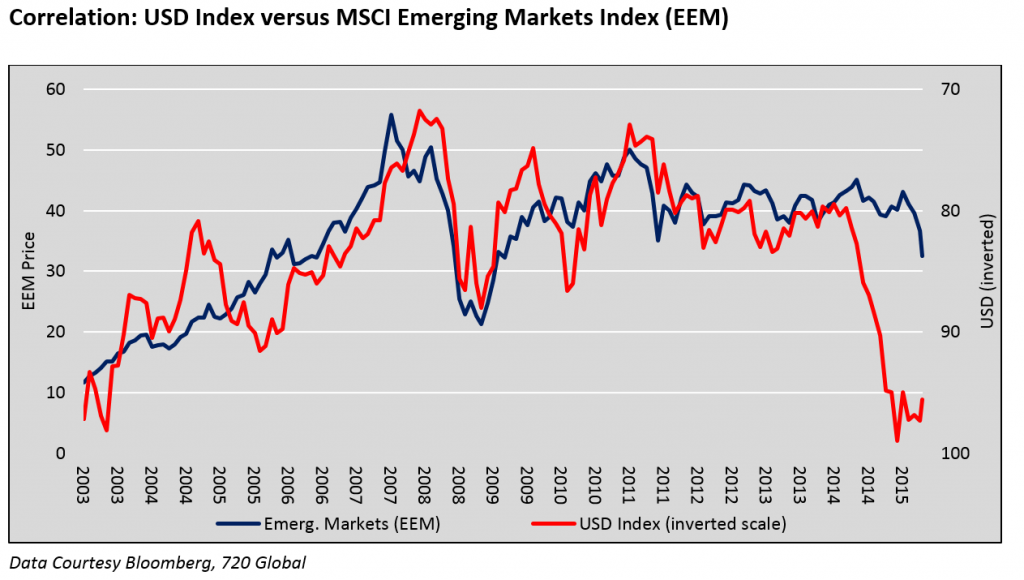

Over the past year, the real trade-weighted U.S. dollar (USD) index increased over 10%, fostering a slowing of global economic growth, increased volatility in financial markets and plummeting commodity prices. This serves as a reminder of the influence the USD has on global trade and asset markets. Periods of dollar appreciation, as highlighted in the graph below, are not well understood by the investing public as there have been only two major appreciation periods since the removal of the gold standard in 1971. The potential consequences from a third major USD appreciation can have a significant effect on expected asset class returns.

The “New” IASG

For the past several months, IASG has been in the process of updating the aesthetics of our site. To do this properly, we conducted an IASG user questionnaire to get a better sense of what users liked, disliked, and wanted to see more of…For the most part, feedback was incredibly good. Users loved the functionality […]

July Results showing good month for Managed Futures

The IASG CTA Index has approximately 75% of managers updated through July performance with almost all sectors posting positive returns for the month. The one exception is the agricultural index where many managers struggled with grain pricing continuing downward pricing and many with expectations that there would be a bounce back in grains.

Kottke Commodities – Little U.S. Business in Wake of Flood Rally

Between late June and end-July, U.S. agricultural prices traced an extraordinarily wide and rapid boom-and-bust, wild even for futures markets. The managers felt well-positioned in corn bullspreads, which did little despite the sharp changes in expectations for supply tightness; apparently it all occurred so fast that the commercial grain business was too frozen to assess and re-position. As December corn rose 90c per bushel in reaction to widespread flooding east of the Mississippi River, and then, après deluge, abruptly fell back 75c, the December-March spread narrowed only a scant 2c and then reversed by as much. The result was a crummy month for us.

12 Questions to Ask Before Selecting a Commodity Trading Advisor

Here is a list that I’ve developed for Individual investors to know the answers to or ask before investing their risk capital with a Commodity Trading Advisor or Professional Money Manager. This checklist is ever evolving as new information comes to light or the dynamics change in the market place. Our hope in providing this […]

IASG May 2015 Performance Results

We have reached the end of June 2015 and compiled nearly 100% of the manager data for May 2014. With five months of performance on record, the IASG CTA Index has turned negative YTD (Past Performance not indicative of future results). We anticipate this trend will hold for the remainder of the month as investors focus now […]

What are Carrying Charges and how do they influence hedging decisions?

In order to fully get the “error” in selling grain at harvest and then buying calls to replace that grain, so as to still participate in possible higher prices you need to understand how carrying charges work in the grain markets. The definition of “carrying charges” is: an expense or effective cost arising from unproductive […]

Advantages & Disadvantages of Call Options for Hedgers & Speculators

Buying (Long) a Call Option: A basic option strategy to be familiar with and learn the advantages and disadvantages of is buying a Call Option (Long Call). Buying a call option is the opposite of buying a put option in that buying a call gives you the right, but not the obligation, to buy the […]

Understanding Risk-to-Reward Ratios in Trading: A Key Factor for Success

When you trade the markets, you don’t know the exact probability of winning or losing on a given trade. You won’t know how much you will profit or lose. A CTA does extensive historical testing on their concepts and trading strategies to understand what to expect. They will also pull huge data samples of market […]

Protecting Yourself in a Locked Limit Market: Utilizing Synthetic Futures Positions

A futures or commodity market is a “locked limit” when trading is suspended due to prices moving the exchange-stipulated daily limit. This can happen for one day (it can even lock-limit and then trade-off), or if given a news event monumental, the market may stay “locked” for as many days as needed for market participants […]

Bulls Being Lured in With Dropping Rig Counts

CNBC is running out of credible, bullish analysts on the oil complex. The calls for $65+ WTI seem relatively sparse. Is anybody in their right mind still thinking crude oil is going higher? Of course. We all know Keynes’ saying, “The market can stay irrational longer than you can stay solvent.” But seriously, how much […]

Measuring the Edge of Entry Signals in Trading

When a CTA or Money Manager is testing or back-testing their entry signals, one of the most important aspects they look at is if the technique’s they are using have a distinct “edge” for the time frame they are trading (short-term, swing, long-term, etc.). Positive price movement is when the market goes in the direction […]