Category: Commodities

Decoding Metals Price Action

Markets often communicate more clearly through price action than through headlines. The dramatic surge in metals contracts is sending a powerful signal, but what exactly is it telling us? Traders frequently monitor inter-market relationships for early warnings. When one asset class moves unusually, it can ripple across the system or reveal deeper structural issues. In […]

Gold’s Resurgence: Can Crypto Really Replace the Yellow Metal?

Once left for dead, gold speculators can sleep easily in 2025 as the yellow metal sits at all-time highs once again. Despite the shift to Bitcoin and other digital assets, the enduring nature of gold as an inflation hedge continues. What is driving this surge, and will cryptocurrencies still win the battle? Reasons for optimism […]

Beef Boom: Why the Long‑Cattle Trade Is Outpacing Stocks

Futures investors often wonder, “If the equity markets are going up, why aren’t we following that trend and making money?” The truth is that many markets can be trending at once or very few at all. Oftentimes, the best trade is in another market completely. One of the best trades recently is long cattle. Yet, […]

Oil Drillers Won’t Drill

One might think that $120 a barrel oil would be incentive enough to start drilling and increase refinery capacity. Still, it appears energy producers are taking politicians at their word when they say they want to eliminate their industry. When the stated goal in Europe and the United States is to phase out fossil fuels […]

Cayler Capital | April Performance Commentary

After finishing off one of the wildest quarters of my trading career, April managed to take the cake. For those that missed it (not sure how you possibly could have), oil settled negative $37. The effects of this were immediate: risk barometers had to be recalculated, option models switched, and most importantly was the immediate […]

Oil Flood – Case for $15 Oil

Guest post by Brent Belote of Cayler Capital Russia broke the oil market! Russia and the Saudis have entered into a dangerous game of chicken with each other. Russia is determined to punish US Oil Producers while the Saudis are attempting to force OPEC+ back in line. To simplify, Russia would not comply with OPEC+ […]

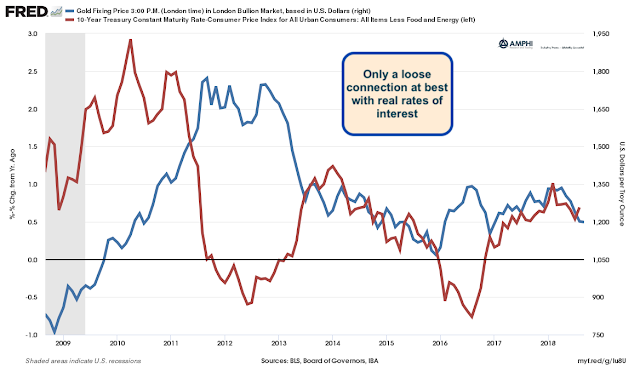

Gold – Not Be A Strong Link To Inflation Nor A Strong Relationship With Real Rates

We have written about the surprising lack of gold price gains with the surge in inflation. A reader has commented that it is the real rate of interest that is important, not inflation. Unfortunately, the data does not seem to show a close relationship.

The Most Diverse Asset Class – The Uniqueness of Commodities

Each asset class is special but have some defining characteristics that make them an asset class. Each also has dispersion in returns within the members in the classification. Commodities are an asset class with a very diverse collection of members which may give very conflicting macro/micro signals.

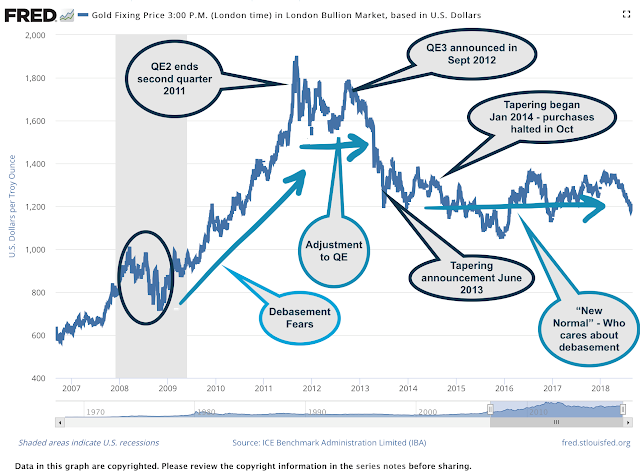

Gold – The Asset We Often Use To Project Fear and Optimism

Gold is hard to understand as an investment. Sometimes it behaves like an inflation hedge but at other times it does not. Sometimes it responds to the real cost of funds, and sometime it does not. It can serve as a safe asset, yet it has sold-off in a crisis. It can be the uncorrelated asset of frustration, but a longer examination tells us about investment deep investor expectations. Gold, over the last decade, can be viewed through three major themes.

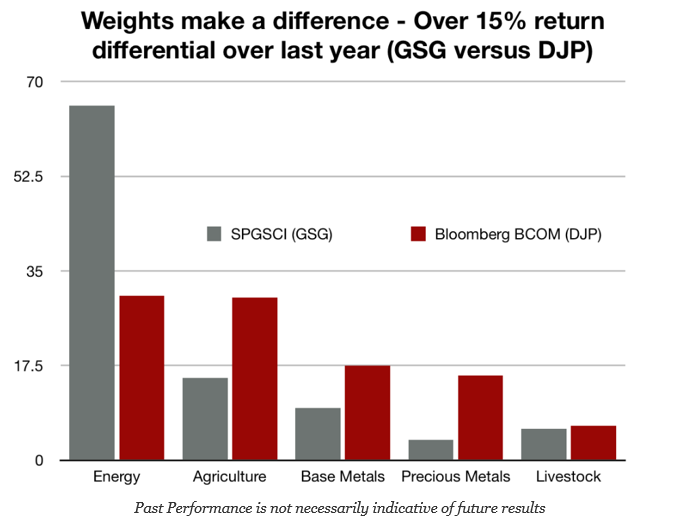

Commodity Gains Existed Over The Last Year, But It Depended On The Index Used

Commodities, as an asset class, have had exciting performance year; well maybe, if you had the right index. A quick look at returns over the last year shows that if you held the SPGSCI index through the GSG ETF, you would have gained a very attractive 19 percent return. If you held the broader-based Bloomberg commodity index (BCOMM) (DJP ETF) you would have received only 3.2%. Both are well-defined indices, but the performance difference would have been in the double digits. This is all based on the weighting of the index. SPGSCI has a 2/3rds weighting in energy while the BCOMM only has a 30 percent energy weighting. If you liked energy, you would have been a star. If you preferred diversity, you would have been made only a slightly positive gain.

The Relationship between Financial and Real Assets is at Extremes – It Can Be Exploited

Correlation is not causality. Blending two variables on the same graph does not make a relationship, but there is a core link with the relationship between real and financial assets. Financial assets are related to the future ability of issuers to generate cash flows for dividends […]

The Relationship Between Financial or Real Assets is at Extremes – It Can Be Exploited

Correlation is not causality. Blending two variables on the same graph does not make a relationship, but there is a core link with the relationship between real and financial assets. Financial assets are related to the future ability of issuers to generate cash flows for dividends or for paying down debt. Growth in real assets are linked to the demand for resources to sustain current and future consumption.

Commodity Returns Over the Long-Run – A Good Diversifier, So Get Back in with an Asset Allocation

Commodity index investing has not been very successful for investors as measured by leading index total returns since the Great Financial Crisis. The end of the super-cycle has been tough on most investors and only recently has there been a period of extended positive returns based on the rise in oil prices. Is there any relief for investors?