Market Overview: Gasoline

- Current demand has climbed to a robust 9 million bpd which is 3.2% higher than the three year average

- At 9.84 million barrels per day, soaring U.S. gasoline production is a whopping 10.6% higher than the three year average

- As of this report, the NYMEX spot gasoline price is at $2.99/gal which is 7.6% below the three year average

- According to the EIA, this summer’s monthly average retail gasoline price is expected to peak at $3.66 per gallon in May and then decline to $3.46 in September. The current average price is $3.596 per gallon.

Outlook

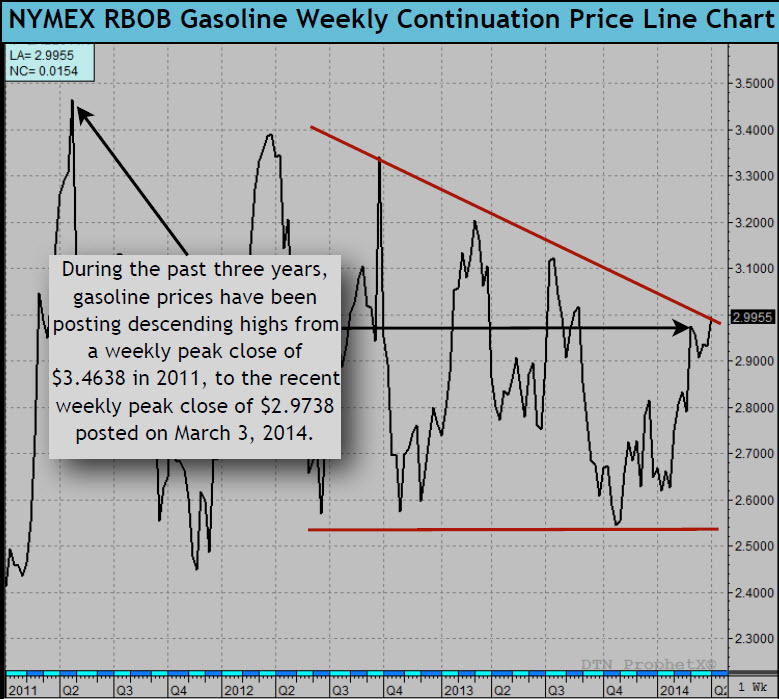

During the past three years, gasoline prices have been posting descending highs, from a peak of $3.47 in the second quarter of 2011 to the recent peak price of $3.05 posted on March 3, 2014. We think gasoline prices will have limited upside due to two main factors:

- Brent crude oil comprises about two-thirds of the price of northeast (NYMEX) gasoline. This summer, we expect Brent crude prices to average $105 or $2 below last summer’s levels.

- Soaring gasoline production will be more than enough to meet summer driving demand and keep prices in check. Given the above-mentioned factors, we think summer NYMEX gasoline prices will remain rangebound between $2.65 and $3.10 per gallon.

Summary

Soaring domestic shale oil production and increased refining capacity have brought a measure of supply/demand balance to the oil complex. As a result, market volatility and price compression has become more pronounced. From a trading perspective, we are adjusting our directional trading strategies to fit the current market environment by reducing individual trade strategy profit goals as well as the concomitant risk. In addition, we will from time to time, utilize option strangles and credit spreads to bracket the market when conditions warrant. Up until last year, bracketing strategies comprised approximately 25% of our trading activity and we are very adept at managing the risk associated with these structures. On a final note, we will be bringing WTI crude oil trading back into the trading portfolio as we now believe the current market better reflects the underlying fundamentals of supply and demand, and less influenced by the trading activity in the WTI/Brent spread. Please feel free to review our performance overview.