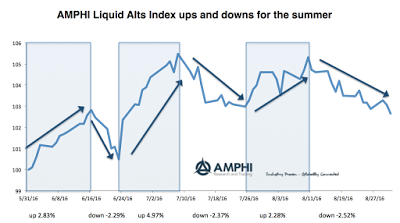

The summer was a positive performance period for managed futures, yet it was still filled with return up and downs. We have identified periods of more than 2% gains and losses on the AMPHI Liquid Alt Index, an equal weighted index of the largest liquid alternative programs available. This return pattern is representative of many periods in managed futures performance with equal gains and loses punctuated by larger gains when there is a market divergence or dislocation. In this case, the main driver was the post-BREXIT market reaction that lasted for approximately two weeks.

Performance dispersion within the index has actually dampened since July. When there are large market price dislocations, there will be greater differences in performance based on whether an individual manager found and properly sized positions in the markets seeing divergences or trends. When there is more dampened or range-bound market behavior, positioning differences will have less impact; consequently, there will be less dispersion in manager performance. Rankings of managers based on summer performance were stable. Managers who performed well earlier in the summer actually stayed at the top of the rankings. Over short time periods, shuffling of performance ranking is less likely to be seen.

Given the current sideways behavior for most major asset classes, it is likely that performance will also stay range-bound. As a positively convex trading style often looking for market trends, managed futures programs need to see larger market moves to generate jumps in performance.