DISCLAIMER:

While an investment in managed futures can help enhance returns and reduce risk, it can also do just the opposite and in fact result in further losses in a portfolio. In addition, studies conducted of managed futures as a whole may not be indicative of the performance of any individual CTA. The results of studies conducted in the past may not be indicative of current time periods. Managed futures indices such as the Barclay CTA Index do not represent the entire universe of all CTAs. Individuals cannot invest in the index itself. Actual rates of return may be significantly different and more volatile than those of the index.

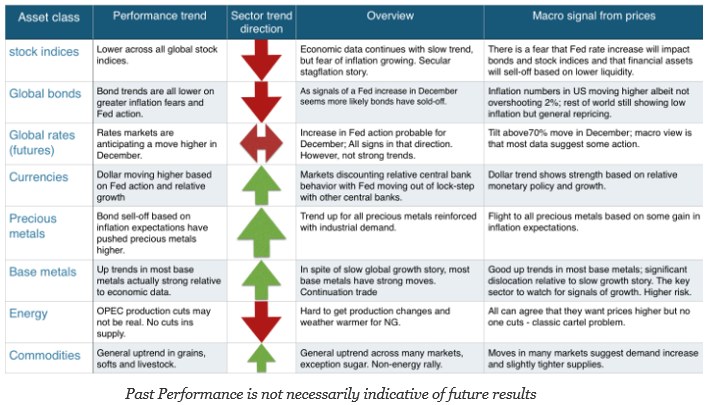

Each month we run a set of trend models against the major markets in each asset class sector. We then average the trend direction, either up or down, to generate a sector signal. The sector signal average can be either up, down, or sideways with a slight tilt positive or negative. These trends are matched against the current fundamental environment. We then extrapolate through a simple narrative what the market is telling investors.

The macro signals are very clear. Stocks and bonds are lower. Risk is coming off the table. More importantly, at this time, there does not seem to be the diversification benefit between these two asset classes. There is no safety with bonds. The strong action in bonds is not matched by the move in short rates; however, the market is already discounting a Fed increase for December. The dollar is stronger after moving sideways for most of the year waiting for clarity on Fed action.

With inflation talk increasing, precious metals have trended higher. The decline in bonds is being offset with a view of inflation safety in metals. Base metals have also moved higher in conflict with the growth expectations of many economists. Energy has moved lower after investors realized that production cut are just more cartel talk. Commodities have generally moved higher across many key markets. Grains have moved higher on export demand.

After a poor performance showing for October, there may be opportunities for trend followers if the current market situation continues. The signals have come from a number of look-back periods, so there is a chance for greater resilience with these makes moves.