Would you buy insurance where the value changes every day with market conditions? An “insurance contract” that may provide a hedge against equity risk today only to see the value of the hedge disappear tomorrow? Of course, the value can appear again, but investors may not have any guarantees. This is recent problem of investing in bonds as a diversification tool. The value of this diversification has become more variable.

Bonds have been the big portfolio diversifier for many investors. It is an insurance policy against equity downside risk because of its negative correlation to equities. The cost of this insurance is the equity-bond return differential.

This negative correlation has been in place for years and is usually enhanced when there is a flight to quality. If the correlation is negative and stable, then there are always diversification gains from holding bonds. The marginal risk contribution as measured by the correlation times standard deviation of bonds is negative. Adding bonds lowers risk. In fact, the value of this diversification can be so strong that the Sharpe ratio may improve even if there are lower returns from bonds. It is an insurance contract that provide a free lunch, the “Great Free Lunch of Finance”.

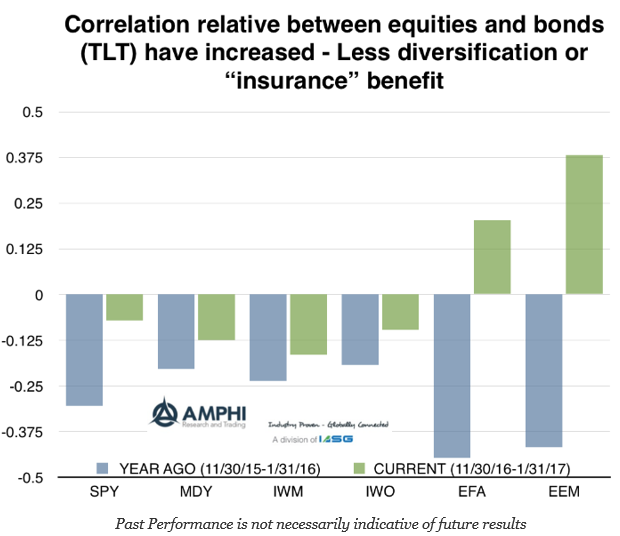

Now, if you are holding bonds under a negative correlation as insurance against an equity decline, the value of your insurance has fallen with each incremental increase in correlation. The correlation between equities and bonds has risen in all cases over the last two months.

Nevertheless, there is a good chance that this will again change over the next three months. The correlation between stocks and bonds is not stable and has increased in variability. Hence, the insurance value of bonds as a diversification tool is uncertain. Cross asset behavior will be a big risk for investors during these uncertain times.