There is the old adage that “trends last longer than expected”, so hang onto your positions. Since you don’t know when trends will end, just stay with those trends as long as possible. Always hold those winners regardless of how long and how far they have run-up. I could place some qualifiers on this adage but it a good base view for anyone who wants to be a trend-follower.

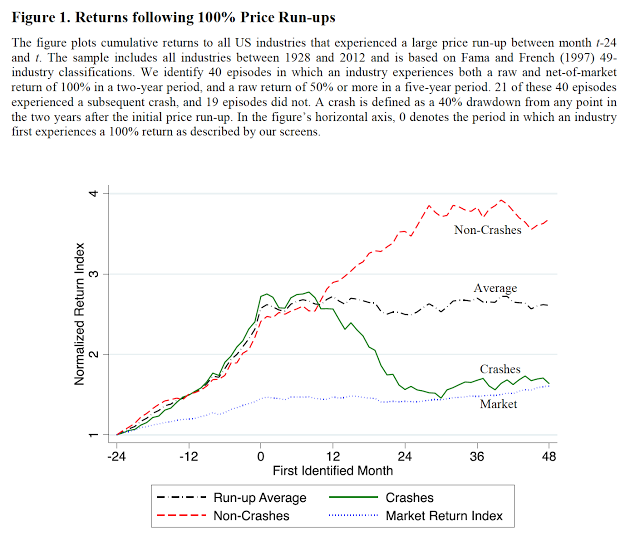

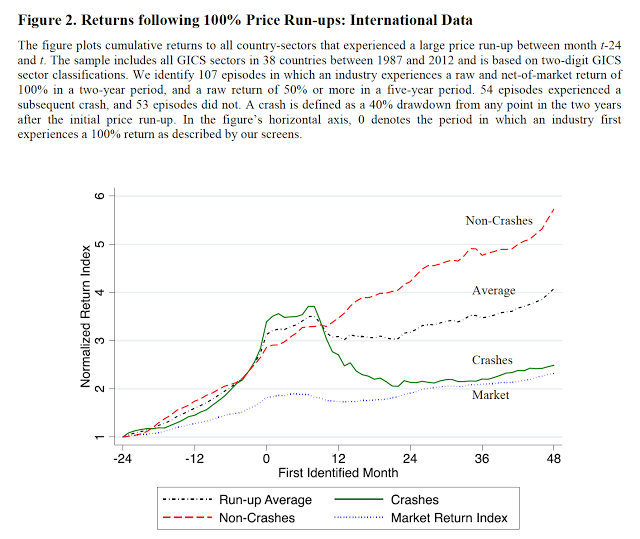

If you look at the data on bubbles, the hold your trends strategy makes sense. Momentum and trend-following is susceptible to crash risks, but the downside may not be as bad as popular narratives suggest. The paper “Bubbles for Fama” by Greenwood, Schleifer, and You takes a deep look on many price booms to determine whether they are always followed by crashes.

There will be crashes after big run-ups in price but it in not a certainty. The numbers suggest a equal chance of having a crash or continuing to run-up in price after a 100% gain. The risks are high, but large gains do not necessitate a crash. The trend is still your friend. And, if there is some form of risk management the chance a trader could end with a gain may actually be high.

The paper also shows that there are indicators which may suggest when a crash is more likely. Factors like volatility, turnover, stock insurance and the price path may all help identify when a crash ay occur. I don’t take boom, bubbles and crash lightly. There are real effects on the economy through the misallocation of resources and there will be losers when the market turns, but the risks should be placed in perspective.