A recent FT article, “Rise in the new form of ‘portfolio insurance’ sparks fear – Popularity of trend-following funds – and their promises – carry echoes for some of 1987 crash” focused on the threat of trend-following to create selling pressure on equity markets. This speculative topic has been a recurring theme for decades and has been extensively researched. The empirical question is very straight forward. Do futures prices lead cash prices and are futures prices driven by systematic trend-followers? That is, is there a positive feedback loop whereby the selling of equity futures by some strategies will lead to more selling and a price crash? The research on the impact of speculators has generally shown that this is not an issue.

There is no focused empirical evidenced that trend-followers create downward pressure that pushes equity cash prices lower. In the blue ribbon panel reviewing the 1987 crash found mixed evidence for CTA’s or portfolio insurance causing the crash. Certainly portfolio insurance may have hastened the decline but systemic selling from trend-followers has not be a cause of crashes. Momentum studies showed there is crash risk with following these strategies but not evidence that momentum trading causes the crashes.

There have been a number of theoretical papers on “noisy” traders which could cause prices to be distorted. There are also theoretical papers which suggest that a positive feedback loop from trend-followers could cause bubbles and crashes. It is possible for bubbles and crashes to be caused by trend-followers if their market size is large enough. Reality may be different.

This is a question of the size of selling pressure. A look at the commitment of traders from the CFTC suggests that there is not a strong level of net short positions from levered accounts or institutions. Of course, that can change and create the selling pressure suggested in the article, but there are no warning signs in the current data.

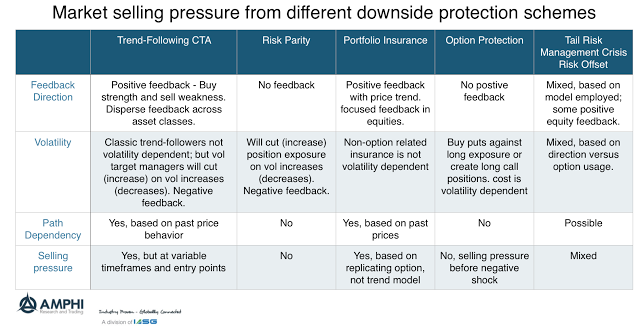

Nevertheless, we can review the type of behavior for the major groups who are offering some type of downside protection and what is there impact on prices. Trend-following CTA’s are not portfolio insurance. Being diversified long/short managers across a broad set of asset classes is not the same thing as being a mechanistic buyer and seller of equity futures based on the notional exposure of the insurance provided. Portfolio insurance is close to option replication. CTA’s are not option replication strategies but price based opportunistic traders.

What CTA’s and portfolio issuance have in common is path dependency based on price, but the exposure to equity futures from any given amount of notional funds will be significantly less than what will be seen with portfolio insurance. In fact, CTA’s may have declining exposure in equity futures if falling prices are matched by higher volatility. Risk parity may generate selling pressure on equities, but from changes in volatility. Option selling will generally not be based on positive price feedback, and tail risk management may come in many forms not all of which are path dependent.

We have agreement with the FT on the fact that downside protection schemes have grown in the last few years and they will have a greater impact because of their size. However, the behavior of different strategies will mean that their impact on prices will be varied and complex and may not come in the form of selling pressure waves like a portfolio insurance strategy.