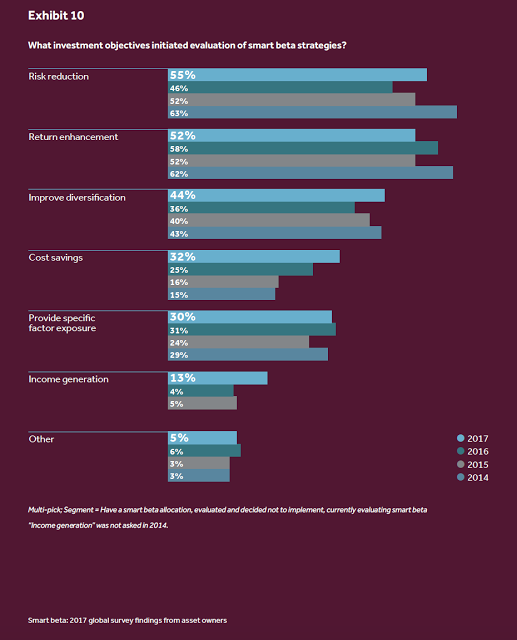

The FTSE Russell annual survey on smart beta does a good job at describing trends in investor thinking with respect to this growing area of portfolio allocation. Smart beta is extending its breath and reach to other asset classes as well as a wider selection of risk premiums and formats. What is still clear is that investors are looking for smart beta in all forms to help with risk reduction and improve diversification. These are the number one and three reasons for holding exposures. Nevertheless, the fastest growing investment objective is cost savings. It is likely that smart beta is being used as a substitute for more expensive active management.

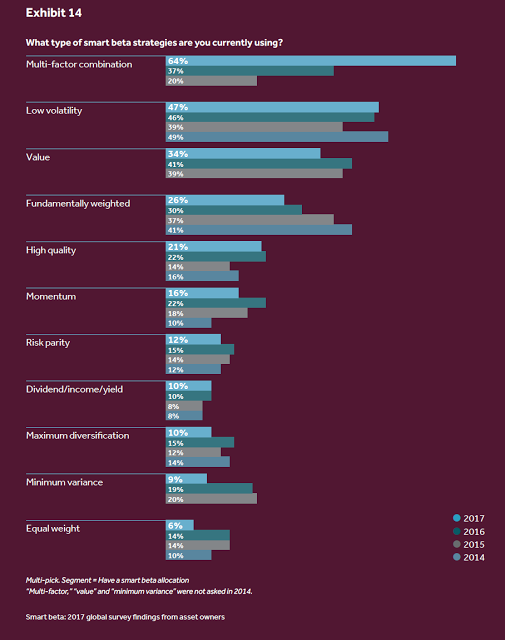

The number one smart beta strategy is a multi-factor combination with low volatility and value coming in second and third. There is a clear investor bias for having factors blended under the name of smart beta.

This desire for multi-factor combinations gets to the heart of one of the key issues of smart beta. At what point is smart beta allocated across a number of factors quantitative active management allocated across a set of strategies through a set of rules? The lines are blurring and this will have an impact on the costs and demand for active managers. The active manager will have to prove whether he is smarter than a smart beta portfolio.