Is it worth trading two highly correlated equity indices? The Euro STOXX 50 and 600 correlation is generally above .95, so most argue that the two are interchangeable. However, there is a significant difference in the volume of each futures contract, so liquidity may not be the same. Hence, some would argue that it is reasonable to choose one. Still, a closer look will show that there are spread opportunities across the two indices no different than the equity spread opportunities in the US based on size or industry mix. Spread trades in index futures offer a way to increase the opportunity set of returns in ways that are often uncorrelated with traditional directional bets.

The Euro STOXX 50 is a mega-cap index of the largest funds in the Eurozone. The average capitalization of the firms in the index is 46.6 billion EUR versus 13.7 for the total market index. The index presents about 60 percent of the overall free-float capitalization of the broader Euro STOXX total market index. France and Germany represent just under 70% of the index market cap, with banks and industrial goods representing 25% of the market exposure. An investor is getting a portfolio of mega-cap names that have a global presence.

The Euro STOXX European 600 index includes the largest 600 names in Europe, representing about 92 percent of the free float total market capitalization. The country mix will have Great Britain, France, and Germany, as the largest country exposure at about 60 percent of the market capitalization. Banks and health care are the two largest sectors at about 25% of the market capitalization.

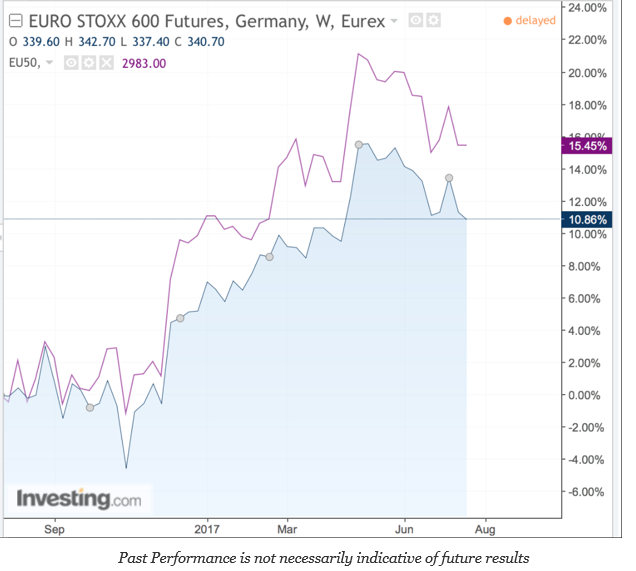

The recent return performance shows the Euro STOXX 50 ahead of the 600 based on the difference in country weights. However, we can see this switching again if there is less BREXIT uncertainty or a switch to more growth in Europe versus the rest of the world. There will also be switching opportunities based on the effects of business cycles and smaller-size firms. These may not be exploited by holding a single index representing “European” exposure. There are additional opportunities associated with trading country versus basket trades. While many of these opportunities are well-known, there may be a greater chance of exploitation as central bank policies change and we move further through the post-financial crisis environment. As stock correlations decline, these indices’ return dispersion should increase.