As someone who is biased toward quantitative work, it has been difficult to judge the impact of political rhetoric and conflict on market behavior. Market uncertainty should increase when there are more partisan conflicts which should translate into higher market risk premiums. Nevertheless, if there is no measure of conflict, this idea cannot be put to a test.

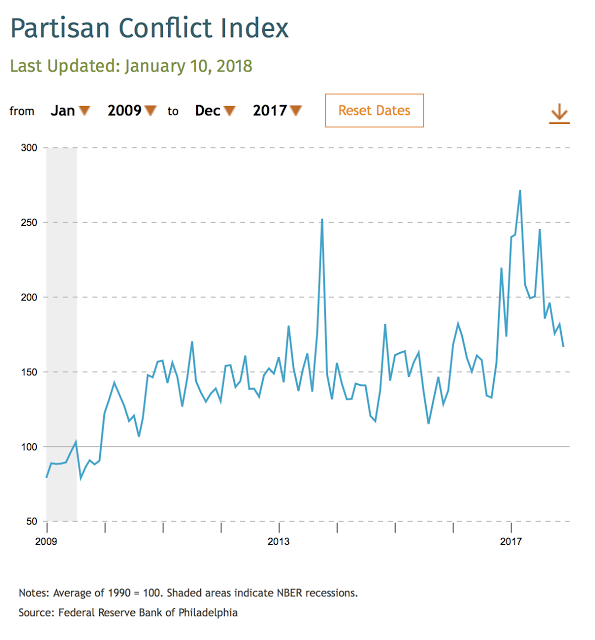

The Philadelphia Fed’s research department has developed a Partisan Conflict index and now reports the results every month. The index data can be displayed in an easy to read chart. The index is based on key word searches from major newspapers which may reveal political disagreement. The author of this work finds that there is a connection between conflict and investment, employment, and output. Higher conflict values lead to a discouragement of economic activity.

The strong decline in 2017 reverses the large spike around the last election. Current values are still elevated relative to the post Financial Crisis average which has been significantly higher than the longer period from 1980-2009.

The caution that many may have had for investing in the stock market during the post Financial Crisis may be the result of this heightened partisan uncertainty. If equity investing is driven by the “animal spirits” of optimism, conflict will dampen risk-taking behavior. This conflict may not be ending, but it may be in the process of normalizing.