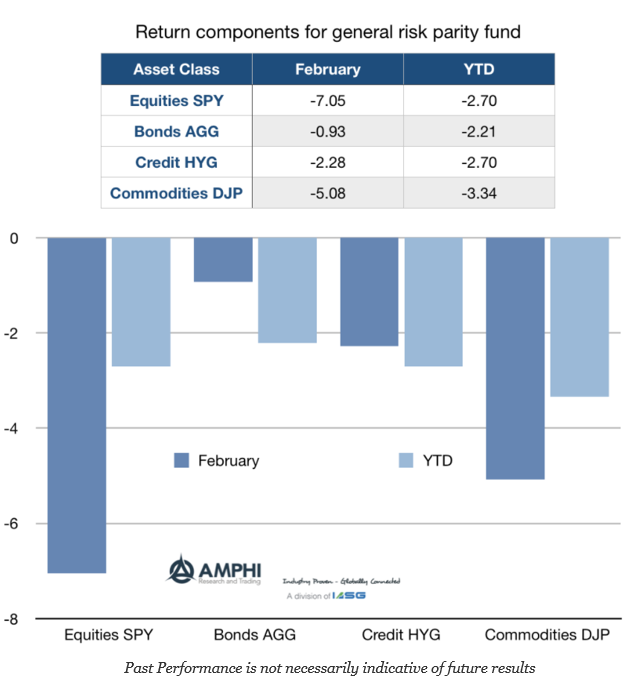

Risk parity has had good performance over the last two years with double digit returns after stumbling in 2015, yet the diversification strategy of equal weighting of four major asset classes has been painful this year. Diversification based on weighting risks offers some protection but is not cure for a volatility revaluation.

All four major asset classes, equities, bonds, credit and commodities have declined year to date and for February. There was no diversification albeit any allocation away from equities was a relative winner. A quick comparison of volatility changes since the beginning of the year shows a range of increases: from 11% for commodities to 41% for bonds, 123% for high yield credit, and 423% for equities using simple 20-day moving averages.

A normal 60/40 stock/bond blend will have approximately 80% of the portfolio volatility in equities, so risk parity may have been more protective given a equal weighting of 25% in equity volatility. The key question is whether the risk parity product used leverage to hit a target volatility.

Risk parity managers had to sell a dollar amount of equities to get back in-line with longer-term volatility weights. This situation was even worse if the program had a target volatility that would have required delevering to bring portfolio volatility closer to target levels. There will be significant differences in performance across managers given their response to volatility, leverage, target levels, and exposures within the asset class, but by being volatility focused there will be feedback effects that spillover to general market moves.

Risk parity products may have done what was expected, but a problem is whether investors truly understood what they were buying in a low volatility environment.