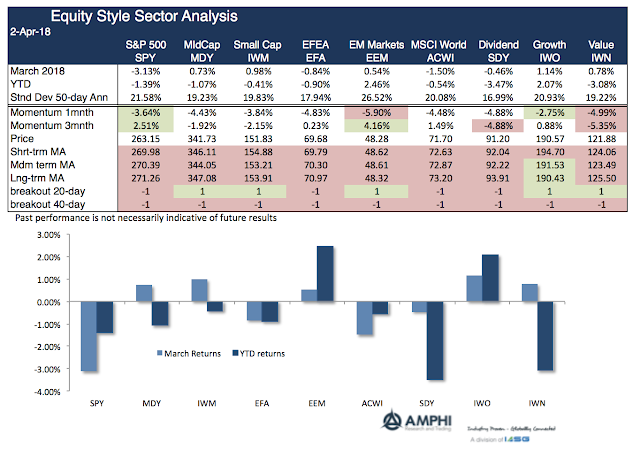

2018 has surprised many investors with a change in focus from economic growth and increased earnings from tax cuts to an emphasis on volatility repricing. Most equity factor and sector styles generated negative returns for the first quarter with the only exception being emerging markets and growth. The only positive price-based signals are within the growth sector.

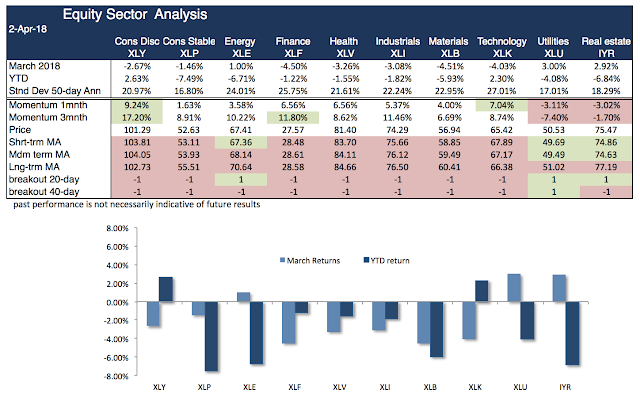

Equity sectors were also generally negative with technology and consumer discretionary as the only two sectors that have generated year to date positive returns. Our moving average and breakout signals only show positive signals in utilities and real estate as bond markets rallied in the second half of the month.

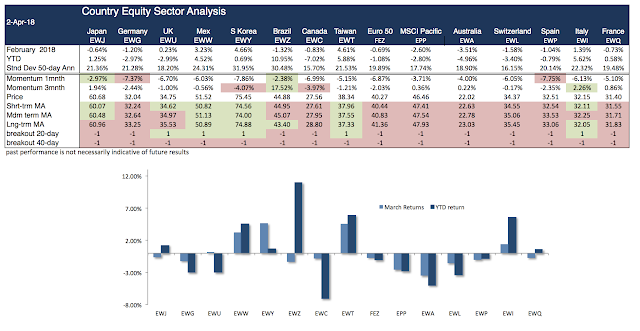

Country equity ETFs showed some large dislocations with Brazil, Taiwan, and Italy being strong performers. Canada and Australia were negative outliers with poor performance. Surprisingly, the best potential trends are with strong global trade countries such as Mexico, South Korea, and Taiwan.

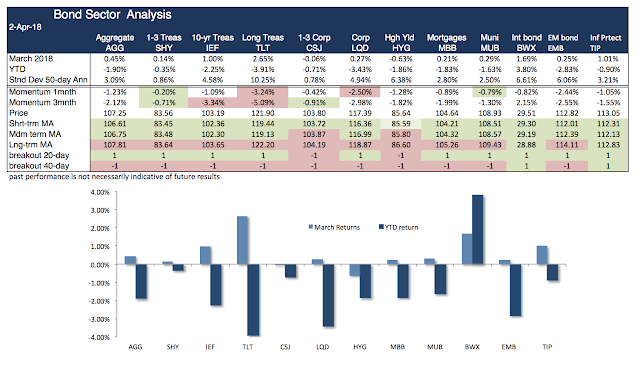

Bond sectors in March showed a strong turnaround in performance relative to last month. Most of the moving average and breakout indicators point to strong bond returns; nevertheless, long duration and credit have underperformed in the first quarter and the only positive sector for the year has been developed international bonds.

The first quarter of the year has generated poor return performance across all asset classes as higher volatility forced a repricing of risk by investors. Markets are seeing a rotation from risky assets to less risky with bonds looking more attractive this month.