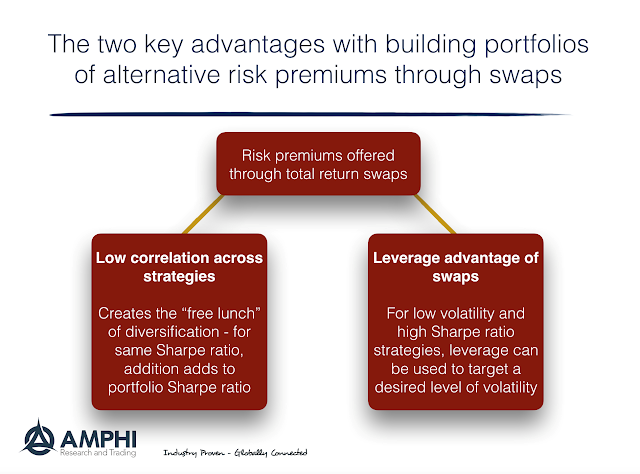

There is a host of alternative risk premiums that are available in the market; some have low returns and low volatility, some good returns but low information ratios, and others have had spotty returns that have moved between good and bad periods. Yet, there is a significant value with these strategies when they are blended together through total return swaps. The value is created through two key features, the low correlation across strategies and the executing through swaps which provides variable leverage.

Most of risk premium strategies are uncorrelated with each other. It is safe to say that most will have correlations that fall between 0 and .5. Their unique return profiles generate true investor value. The uncorrelated nature of alternative risk premiums allow them to gain the “free lunch” of finance when bundled in a portfolio, diversification. These strategies can be blended together to form portfolios that actually have higher Sharpe ratios than the premium strategies on their own. The decline in volatility is greater than the weighted average of returns.

Because these strategies can be executed through total return swaps, these risk premium strategies have the added feature that they can be levered to equalize risk across strategies and can use leverage to hit any portfolio volatility target. This is especially important because many risk premium strategies have very low volatility but relatively high Sharpe ratios. The true value of risk premium investing can be achieved through leveraging to a higher volatility. This can be achieved through investing in swaps.

Given that low correlation and low volatility combined will lead to even lower portfolio volatility, the leverage available in swaps allows for meeting portfolio volatility targets that are consistent with the needs of investors. An unlevered 5% volatility portfolio with a 1.2 Sharpe ratio will still not cover the discount rate used by many pensions (7%). The swaps can be structured to reach a 10% volatility and generate potential returns that are above discount rates and still be uncorrelated with traditional investments.

There are still challenges with alternative risk premium. Multi-strategy index portfolios have not shown compelling returns. Investors still need to pick premium combinations that work, yet the low correlation and leverage advantages makes risk premium investing an interesting alternative to hedge funds.