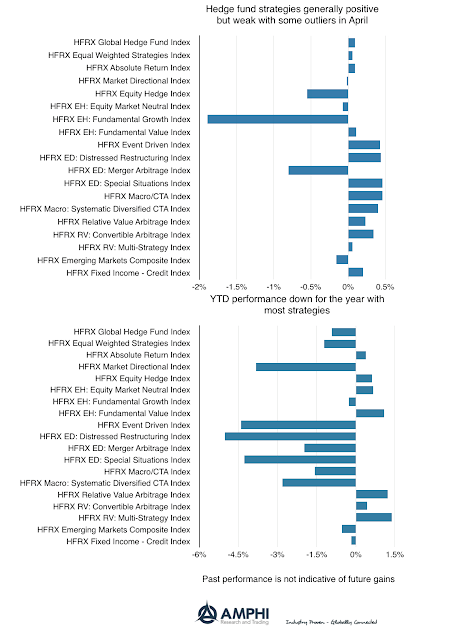

Most hedge fund strategies were positive for April, but the average return was less than 50 bps. There were two negative outlier strategies with fundamental growth and merger arbitrage. Generally, the higher monthly volatility and dispersion created a mixed environment for return generation. Year to date returns suggest that it has been a difficult four months for most managers with average loses much larger than the average for the winners and only 7/19 strategies producing positive returns.

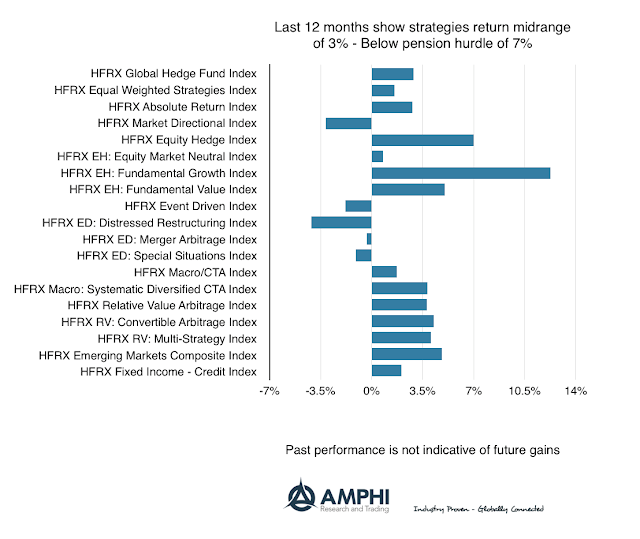

In spite of the difficult last four months, 12-month returns have still been positive although these returns are below the discount rate used for many pensions. Only equity hedge and fundamental growth were close to the 7% target. The area of most difficult performance has been the event driven strategies. Money has stilled moved into hedge funds, but investors are expecting stronger performance than what they have seen recently.

Past performance is not necessarily indicative of future results.