Historian Deirdre McCloskey says, “For reasons I have never understood, people like to hear that the world is going to hell.”

John Stuart Mill wrote in the 1840s: “I have observed that not the man who hopes when others despair, but the man who despairs when others hope, is admired by a large class of persons as a sage.” from Morgan Housel “The Psychology of Money”

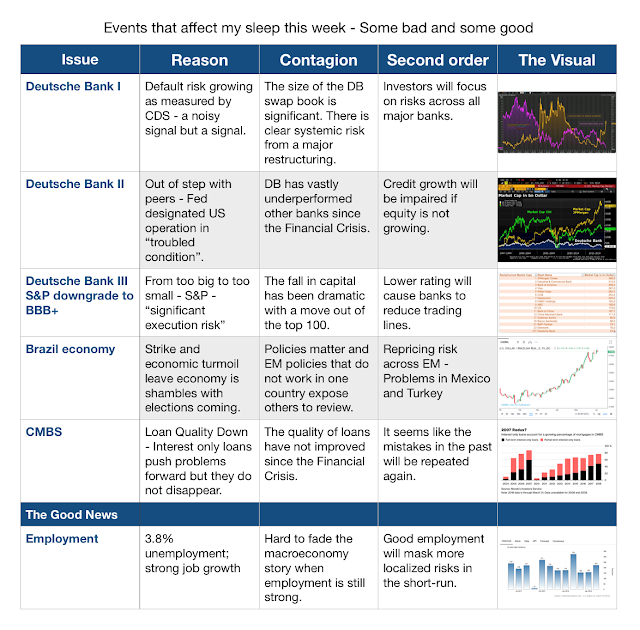

Yet, here I am talking about what may cause me to lose sleep. Am I falling into the same trap described in the quotes above? Yes, but I would like to believe that focusing on the possible extremes or dangers help protection wealth. The cost of complacency is high. A lose of principal requires more future return to reach breakeven. This is the drag of volatility.

This week here are three issues of concern. One, Deutsche Bank. The decline in a global bank has systemic risks which are hard to unravel. Reduction in lending for one bank cannot be immediately replaced with another bank. Governments do get involved, and financial plumbing is important. Second, the Brazil turmoil is can lead to unintended future policy consequences with a election coming up. Forecasts have actually increased growth for 2018 to 2.0% from 1.6%, but the strike impact looks to be more far-reaching. It should cause concern for any EM investing. Third, the quality of loan portfolios in CMBS should be a concern. Interest only loans never are a good sign of quality.

Nevertheless, good macro data in the US lifts the global boat. With employment still improving, it is harder to bring any localized negative concerns forward in time as global issues.