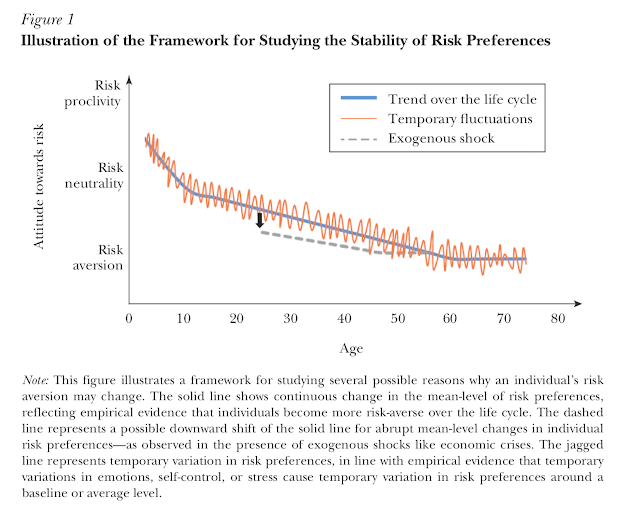

An important problem in finance is trying to properly incorporate risk preferences when forming portfolios. This is especially true if risk preferences are not stable. Yet, we have increasing evidence that risk preferences do change over time. (See article “Are risk preferences stable?” by Hannah Schildberg-Horisch in the Journal of Economic Perspectives Spring 2018 and illustration below.)

First, individuals become more risk averse as they age. Older investors become more cautious and conservative. Second, there is an increase in risk aversion during an economic crisis or downturn. Risk aversion is countercyclical which can explain why the equity risk premium is higher in recessions. This can also explain why investors who lived through economic crises, like a depression, act more conservative than investors in the same age category who did not experience a depression. Third, stress, fear and cognitive load will elevate temporarily risk aversion.

Risk aversion may not be stable through time, but it may be stable when measured by traits which is consistent with how psychology looks at risk aversion.

This idea of changing risk preferences can be very useful at explaining both investor and manager behavior. The change in risk aversion as we age is consistent with the target date products that become more conservative through time. The risk aversion from economic crisis suggests that many avoid holding risk portfolios at times when upset is best. The fear factor suggests that portfolios will become more conservative during stress. The impact of risk aversion on investors seems acceptable to our understanding of market behavior, but we should also accept that risk aversion impacts manager behavior.

Managers are likely to become more risk averse as they age. The gunslinger of yesterday will become more conservative with his grey hair. Managers are not immune to a crisis will become more conservative during a recession. Managers will increase their risk aversion when there is more stress.

Given this time-varying pattern, there is a good reason to hold systematic strategies that will not show changing risk aversion. Disciplined rules-based approach can eliminate this behavior in managers.