Can anyone who has technical knowledge become a good money manager? This is a fundamental question for the quant revolution.

Ask many quants and the answer will be yes. At the extreme, the quant does not need to have any specialized knowledge of the underlying markets or names of the assets to be traded. Of course, there needs to be knowledge of the rules of the game, but nothing beyond that. Technical knowledge is supreme and trumps any of the practitioners in money management.

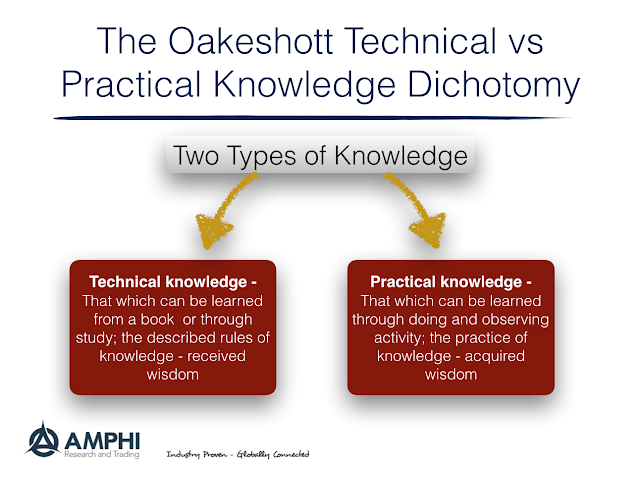

There are others who would say that technical knowledge is not enough. There is also something called practical knowledge that is as important. Practical knowledge is learned through practice, tradition, and mastered through an apprentice. Practical knowledge is what cannot be taught through reading a book.

Think of cooking as a simple example. You can get all of the technical knowledge you want from cookbooks. There will be recipes and outlines of all of the steps. There will be a complete list of ingredients and pictures of what the meal should look like. There may even be instructions on how to prepare all of the ingredients. Unfortunately, as most will know, there is a big difference between this technical knowledge and the practical knowledge of cooking.

This dichotomy of knowledge accumulation (practical versus theoretical or technical) was developed by the philosopher Michael Oakeshott. Taking quotes from his master work Rationalism in Politics and Other Essays:

Every science, every art, every practical activity requiring skill of any sort, indeed every human activity whatsoever, involves knowledge. And, universally, this knowledge is of two sorts, both of which are always involved in any actual activity… The first sort of knowledge I will call technical knowledge or knowledge of technique. In every art and science, and in every practical activity, a technique is involved. In many activities this technical knowledge is formulated into rules which are, or may be, deliberately learned, remembered, and, as we say, put into practice; but whether or not it is, or has been, precisely formulated, its chief characteristic is that it is susceptible to precise formulation, although special skill and insight may be required to give it that formulation… The second sort of knowledge I will call practical, because it exists only in use, is not reflective and (unlike technique) cannot be formulated in rules. This does not mean, however, that it is an esoteric sort of knowledge. It means only that the method by which it may be shared and becomes common knowledge is not the method of formulated doctrine. And if we consider it from this point of view, it would not, I think, be misleading to speak of it as traditional knowledge. In every activity this sort of knowledge is also involved; the mastery of any skill, the pursuit of any concrete activity is impossible without it.

These two sorts of knowledge, then, distinguishable but inseparable, are the twin components of the knowledge involved in every concrete human activity… Again, these two sorts of knowledge are involved in any genuinely scientific activity. The natural scientist will certainly make use of the rules of observation and verification that belong to his technique, but these rules remain only one of the components of his knowledge; advance in scientific discovery was never achieved merely by following the rules… Nor, in these arts, is it correct to say that whereas technique will tell a man (for example, a doctor) what to do, it is practice which tells him how to do it–the ‘bed-side manner’, the appreciation of the individual with whom he has to deal.

Oakeshott was a skeptic of pure rationalism or at least a significant overweight on technical knowledge relative practical knowledge based on experience and tradition. Uncertainty requires both. While Oakeshott is noted for his political philosophy and conservative views, his thinking focuses on the need for a balance between rationalism and tradition. There should be a desire for pragmatism over pure ideology.

Applied to money management, there should be a skepticism against the pure embracing of quantitative investing over a mix that include practical knowledge learned through experience and handed down from through working with doers.

This can dichotomy can be seen with discussions on efficient markets. Technical knowledge based on theory would say that trying to beat the market is a fool’s game, yet practical knowledge always suggested that looking at the behavior of others and the action in prices made better decisions. To a degree, the practical knowledge that investors make mistakes allowed the development and acceptance of behavioral finance developments. Regardless of our knowledge of corporate finance, the practical knowledge of understanding the personality of the CEO made a difference with investment decisions.

Finance has been filled with new ideas based on quant analysis, but their lack of success in the “real world” may force us to scrap or modify based on our practical knowledge.