The returns of alternative risk premium strategies and products developed by banks and investment managers will have close links with the underlying macro relationships that are modeled. In the case of credit carry risk premiums, investors will gain from the difference between high yield and investment grade spreads. In the case of rate carry risk premiums, returns will be tied to the term premium in the yield curve.

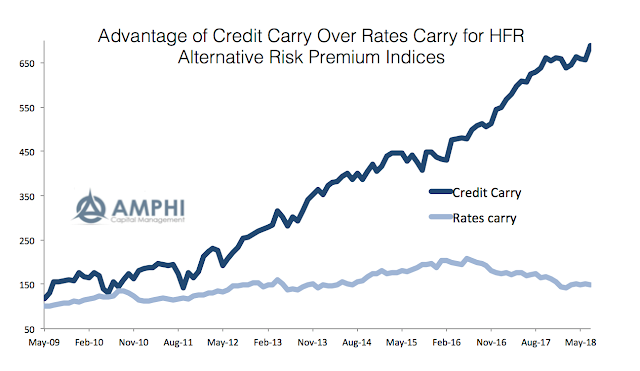

The credit carry HFR alternative risk index shows the strong returns generated since the end of the Financial Crisis. The rate carry risk premium shows positive gains albeit lower than credit carry.

There has been a general decline in the spread between high yield and investment grade corporates since the Financial Crisis. There has been significant gains from carry positions in credit risk premium products since the high reach at the height of the crisis. There have also been gains in holding term premium in Treasuries since the Financial Crisis, but these gains have been more limited because the spread and change in the term premium has been less.

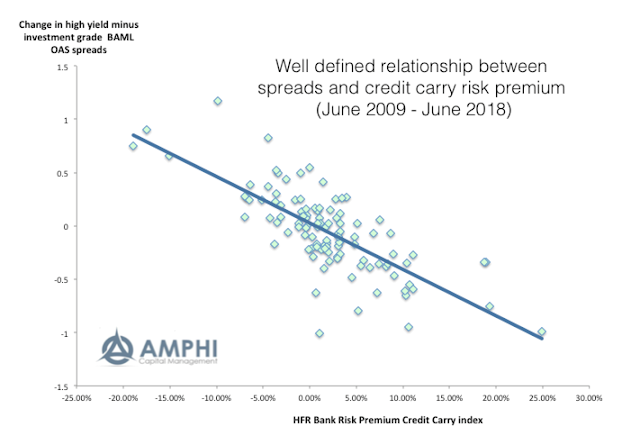

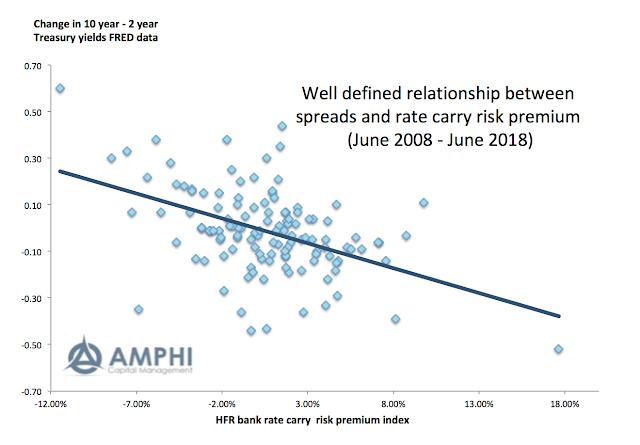

There has been a close relationship between the change in spreads and returns with the HFR carry risk premium indices. This exists for both credit and rates.

There has been a view that investors should build diversified portfolio of risk premiums because you don’t know where returns will be generated. Investors should hold carry, value, momentum, and volatility across all asset classes because this will give you the best risk-adjusted returns. This is a sound strategy, but we actually know a lot about the behavior of some risk premiums and this will help with building any portfolio.

For example, credit carry will not be as attractive for the simple reason that as the spread between high yield and investment grade debt close, there will be less carry opportunity. The same can be said for rate or term premium carry trades. These carry spreads will change with the business cycle, so that as we move from recession to recovery and onto expansion there will be a change in the return opportunity set. The returns will be time varying but will be tied to business cycle performance. Hence, the strong returns associated with the performance of credit carry strategies will unlikely continue. Similarly, as the term premium (yield curve) flattens, there will be less return opportunity for rate carry.

A diversified strategy of holding different style risk premium makes perfect sense, but our knowledge about the relative and absolute performance of these strategies that can help with determining any portfolio mix.