IASG, Author at IASG

Dollar smile – We are moving to the smile bottom

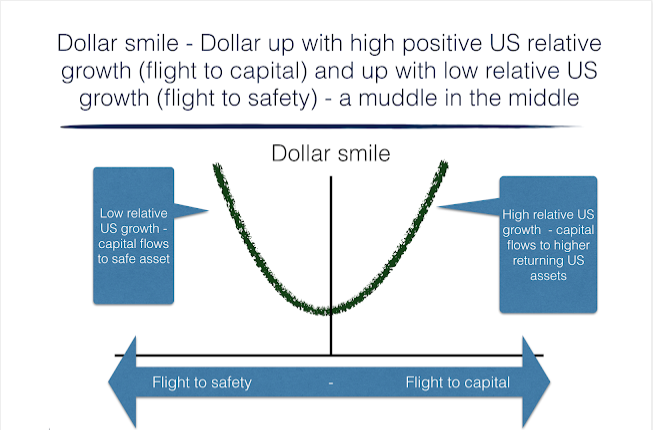

A good simple approach for framing the longer-term movements in the dollar is through using the narrative of a dollar smile. We have written about this years ago, but think it is relevant today. The dollar smile, first popularized by Stephen Jen, says that currency behavior is driven by two competing regimes. Regime 1 is […]

The Capital Appreciation Program: Spreads ‐ A Unique Approach to the Energy Sector

Corporate Summary Tyche Capital Advisors, LLC is a New York based registered commodity trading advisor currently offering trading programs to qualified investors. Through its trading programs, TCA will engage in speculative trading of futures and options contracts offered on the United States commodity exchanges and overseas futures exchanges. Tariq Zahir and Steve Marino are the […]

Managed Futures: Portfolio Diversification Opportunities

WHAT ARE MANAGED FUTURES? The term managed futures describes a diverse subset of active hedge fund strategies that trade liquid, transparent, centrally-cleared exchange-traded products, and deep interbank foreign exchange markets. Managers in this sector are called commodity trading advisors (CTAs) and their strategies are largely focused on financial futures markets with additional allocations to energy, […]

10 Reasons to Consider Adding Managed Futures to Your Portfolio

1. Diversify beyond the traditional asset class Managed Futures are an alternative asset class that has achieved strong performance in both up and down markets, exhibiting low correlation to traditional asset classes, such as stocks, bonds, cash, and real estate. 2. Reduce overall portfolio volatility In general, as one asset class goes up, others go […]

Definitions and Formulas

Arbitrage: Several sub-strategies fall under arbitrage. The most prevalent in the managed futures industry is statistical arbitrage. A simple example is simultaneously buying gold on one exchange (for a lower price) and selling gold on another exchange (for a higher price). This strategy looks to profit from the price difference. Average Commission: This represents the […]

Bull Market with Higher Risk – Looking into 2018

2017 will go down as one of the most remarkable years for the US Stock market on record. The Dow Jones closed with 71 record highs which is a record in itself. The Dow posted a record high almost every three days. The S&P 500 posted gains of 19.4% with near-record low volatility while enduring geopolitical tensions, massive natural disasters, political turmoil in Washington and a tightening of monetary policy. In fact, the market currently has the calmest price fluctuation in 50 years, with the S&P 500’s average (daily up-or-down moves) a mere 0.30%. As a comparison, this is over half the move last year and almost a sixth (1/6) of the average daily move in 2008. It’s the smallest absolute daily move average since 1965; we had to trace back to 1964 when S&P 500 average daily move went below 0.3%. (Figure 1).

Rincon Capital – A Rising Tide Lifts All Boats

John F. Kennedy’s aphorism “a rising tide lifts all boats” seems to be particularly appropriate when describing the results of both the domestic and international equity markets these past 30 days.

Crunch Time in Bond Markets Makes Equities More Vulnerable

Since the post Brexit plunge in bond yields, we have been becoming more negative on bonds. Along with virtually everyone, except central bankers, we have been banging the drum of how insane negative bond yields are. However, with many institutional investors required to hold Government bonds due to regulatory and capital requirements, and central bank’s QE exceeding global Government bond supply, it was almost understandable how bond yields could remain in sub-zero terrain. Understandable yes, but that did not make them good investments!

Can The World Cope With a Resurgent Dollar?

There is no doubt that big swings in the value of the US Dollar have a big impact on global economic growth and also financial markets performances. Between June 2014 and January 2016, as the Dollar rose by over 20%, global equity markets struggled (Emerging Markets suffering the most), commodity prices plunged and deflationary concerns moved front and center. After the Dollar topped in late January, everything has turned around. The Dollar has traded sideways, financial markets have performed pretty well overall and economic concerns have abated. Although it cannot all be about the Dollar, we need to recognize that the Dollar is extremely important for both financial markets and the global economy.

August Calm Gives Way to Limited Opportunities for Managed Futures

September came and went with a relative whimper. It was our view that various key macro events scheduled throughout the month coupled with uncertainty over monetary policy, had the potential to produce significant moves across global markets. As it turned out..with the exception of the commodities sector…this was not the case. U.S. equities ended the […]

Gemini Alt & IASG Alternatives Announce Technology Integration

CHICAGO, Sept. 13, 2016 /PRNewswire/ — The Gemini Companies announces that its affiliate, Gemini Alternative Funds, LLC (http://www.geminialt.com), has completed a software integration with IASG Alternatives LLC. As part of a strategic relationship, prospective Gemini Alt investors will have access to the IASG Alternatives managed futures database without leaving Gemini Alt’s Galaxy Plus managed account […]

CTAs Stung by Low Volatility in August

Following a flat July, CTAs struggled in August. A concomitance of low volatility, range bound markets, lack of follow through on existing trends, as well as an emergence of new trends, resulted in negative performance for several managers. The extremely low volatility environment was challenging for most systematic managers as their strategies had little to work with. This absence of any meaningful follow through resulted in a portion of previously accrued gains being absorbed back into the markets.

CTAs Set to Thrive at End of QE Era

In the midst of any foggy economic phenomenon, it’s difficult for an industry to really assess how it’s being affected. But with time comes clarity, and it’s now possible to look back on the past eight years of Fed policy and draw broad conclusions about how Quantitative Easing actions created headwinds for investors in the managed futures space. Crucially, these conclusions give us a reason to feel optimistic looking toward 2017 and the return to a world of abundant, varied trading opportunities.