Category: Managed Futures

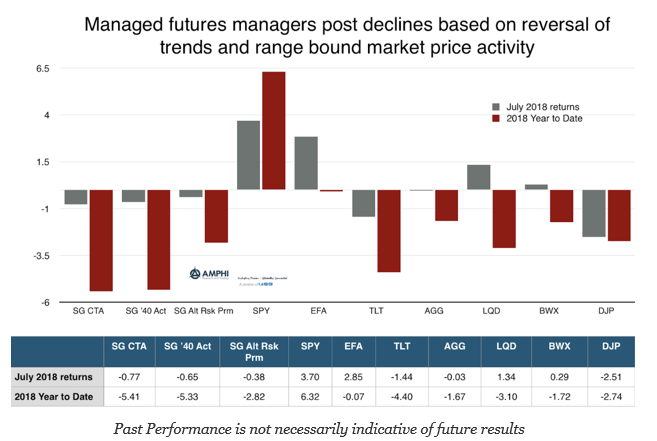

If There Are No Trends, There Will Be No Gains – Managed Futures Slightly Negative On Range Bound Market Behavior

July proved to be a classic reversal from less risk appetite to risk-on behavior. Global equities, which were weak in June, reversed on the expectations of stronger growth and earnings. This was bad news for trend-followers positioned for further market declines. The switch in risk appetite caused bonds to move lower. The strong growth, higher inflation, expected larger supplies, and expectations for continued Fed QT placed added pressure on Treasuries. Credit markets moved in-line with equities. The range bound currencies helped international assets but did not allow for trading gains. Commodities were mixed with energy prices moving lower and grains seeing some buying pressure after large declines last month. All of these reversals did not help intermediate trend traders.

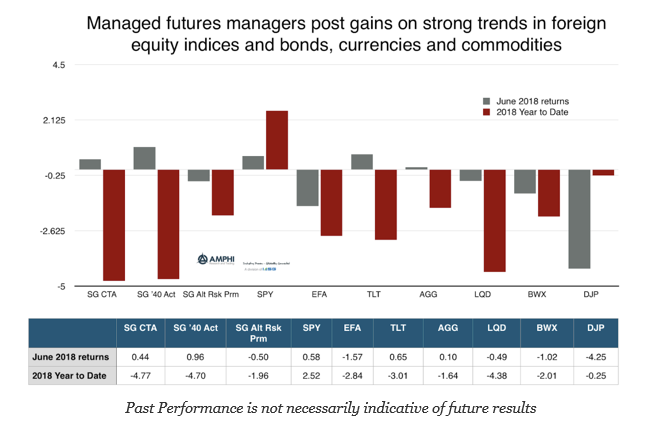

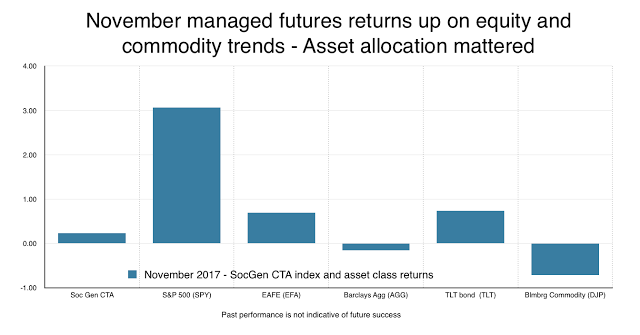

Managed Futures Show Gains versus Other Asset Classes Based on Good Trends

Based on the performance of the SocGen indices, the average managed futures fund generated positive returns for June. The performance of the Barclays BTOP also was up 59 bps and is only down three percent for the year. Managed futures outperformed all of the major asset class ETFs based on strong trends across a number of asset classes.

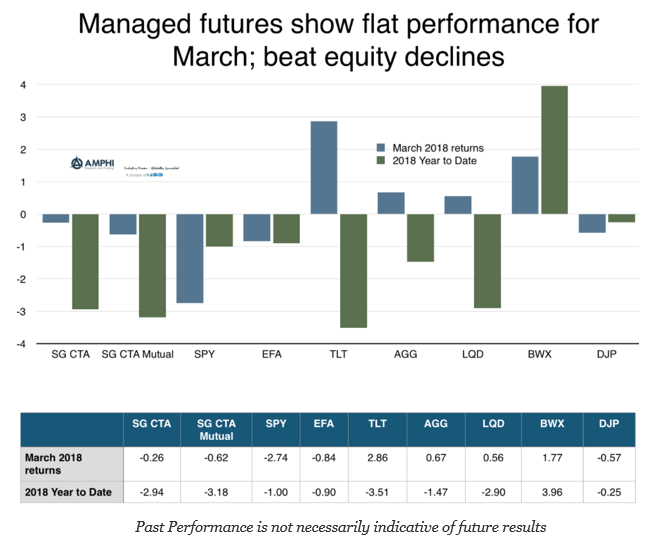

Managed Futures Slightly Down for Month – Better than Equites

Managed futures index returns were slightly negative for the month with the SocGen CTA index down 26 bps and the SocGen CTA mutual fund index down 62 bps. The BTOP 50 index gained 26 bps for the month. This compared favorably against many equity indices, but was less than the fixed income indices. Trend-following managers were not able to catch the early rotations from equities to bonds during the second half of the month.

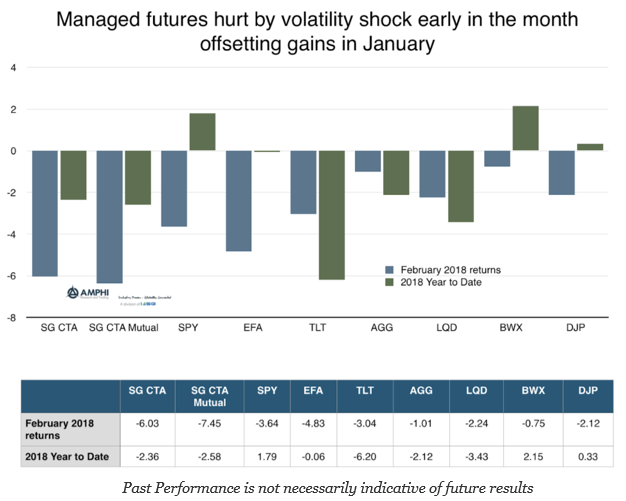

Managed Futures Managers Hurt By Volatility Shock

The managed futures hedge fund category generated poor performance in February as measured by the SocGen CTA index and the SocGen CTA mutual fund index. This behavior was also seen in the BTOP 50 index which declined 5.29 percent for the month. The SocGen short-term traders index was down 4.31 for the month but still up for the year by just over 1%. Nevertheless, the year to date return numbers for managed futures are better than long duration bond performance and the credit sector as measured by the TLT and LQD ETFs.

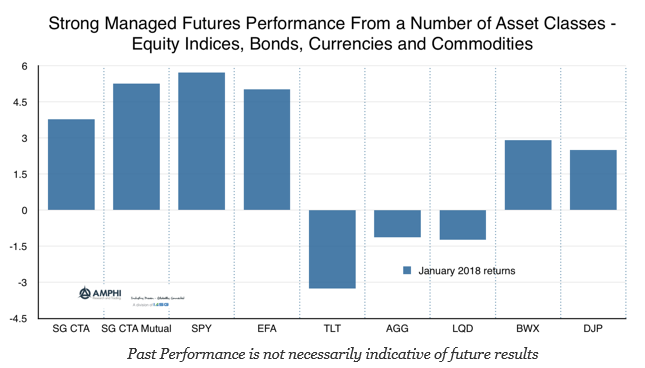

Strong Managed Futures Returns from Multiple Asset Classes – Consistent with Fundamentals

Managed futures showed strong performance in January from a variety of asset classes. Many managers were able to continue to take advantage of the trend in US equities, albeit with a giveback of some profits at the end of the month. Global bonds generated gains from short positions as a significant sell-off accelerated through the month. The dollar decline made trading currencies also profitable. The trend in oil and refined products also continued although a surprise inventory increase at the end of month added volatility. Selective trading in precious and base metals also added to performance. There were also commodity opportunities from newly formed trends.

AMPHI Research & Trading’s Systematic Global Macro 2018 Conference Call

IASG Inc. in collaboration with AMPHI Research & Trading will have a discussion with EMC Capital Advisor’s President John Krautsack Thursday January 18th at 11:00 AM EST. Hear about the EMC Alpha Plus Program’s unique portfolio construction, model design and why it has built a three-year track record of superior risk-adjusted returns versus other global macro […]

Managed Futures Up for Month and Positive for the Year Even in a Risk-On World

Much has been made about the value of managed futures during periods of market crisis, but there are also some other regularities that have been found for this strategy that can help with understanding performance.

Slicing the Pie for Better Allocations Using Managed Futures

At the end of the year, investors will review their asset allocation decisions. Often investors will think about their pie chart exposures to different asset classes and strategies. Too often the focus is on asset class allocations and not enough on strategy differences. The problem with asset classes is that correlations may change significantly in a crisis with the usual problem being a movement to one. Diversification is not present when you need it.

Managed Futures is not Trend-Following but it is Close – Broadening the Product Spectrum has Added Strategy Complexity

I would not be the first person to engage in the lazy thinking that managed futures are synonymous with trend-following. For many years, there was little wrong with using both terms to mean the same thing. The majority of managed futures are still trend-following.

Rincon Capital – A Rising Tide Lifts All Boats

John F. Kennedy’s aphorism “a rising tide lifts all boats” seems to be particularly appropriate when describing the results of both the domestic and international equity markets these past 30 days.

Corporate bonds and Managed Futures – A Winning Diversification Combination

Managed futures may not generate crisis alpha if there is no crisis, a sustained decline in equities. In addition, managed futures may not provide as strong a cushion diversification effect during normal times since the correlation between equities and managed futures is slightly positive, and there is no managed futures yield. So how can an […]

Managed Futures Slightly Positive in a Choppy Environment – Performance Driven by Asset Class Weights

Managed futures managers were, on average, positive for the month with returns beating commodities and the fixed income Barclay Aggregate index. Managed futures did not beat the strong equity performance but that should not be a surprise given that equity exposure will only be a small portion of the total risk exposure for managers. Most managers will cap the equity exposure within the program, so even if equities are trending higher, performance will lag a long-only index.

Active Cash Management for Managed Futures – A Simple Addition to a Fund’s Return Profile

Managed futures have unique features given that margin is only a small potion of the total investment. This allows for active collateral management in ways that are more impactful from other hedge funds. For most hedge funds that use a prime broker and make long/short equity investments, the focus of collateral management is with reducing the cost of borrowing. For futures, the leverage is not through borrowing but through the ability to increase notional funding based on the level of margin to equity. A good portion of funds given to any CTA is not managed efficiently but rather just held in cash.