Category: Managed Futures

Size Matters with Managed Futures but Not Just with Performance

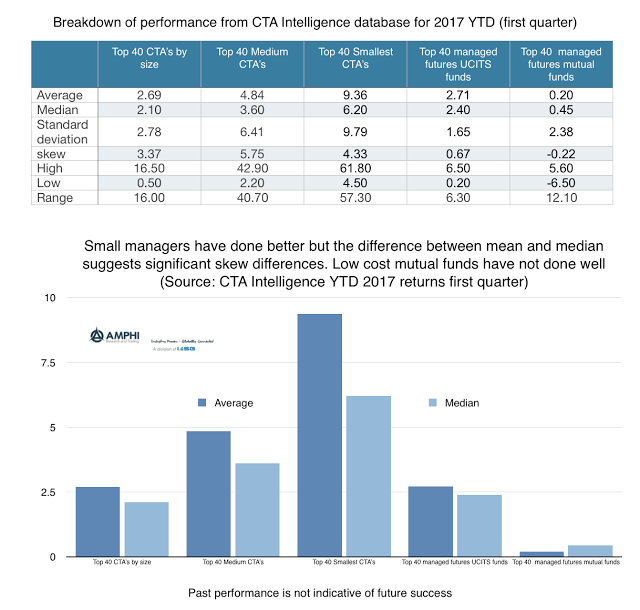

There has been a preference for large managers within the managed futures space as measured by money flows, but it comes at a cost. Looking at year to date performance from the CTA Intelligence performance database shows the differences in performance based on size. What is clear is that the average performance of a set of 40 small managers is significantly higher than the performance of the largest 40 managers. Going down in size will allow clear increases in average return and with median returns; however, a closer look shows that the price of obtaining higher returns can be high in terms of regret.

The Effectiveness of Managed Futures: Exploring Trend-Following Strategies

Why is managed futures or, more precisely, trend-following an effective investment strategy? Many managed futures programs have been successful by keeping it simple and using heuristics like following the price trend and not always using all the available information about a market. Disciplined and systematic decision-making seems to be a robust means of dealing with […]

Volatility and Managed Futures – Is There a Relationship with the VIX?

Many believe that managed futures is a long volatility strategy because the strategy is like being long a look-back straddle. We believe there is a more nuanced story associated with long gamma exposure, but let’s use the prevailing wisdom of long volatility as a starting point for a discussion.

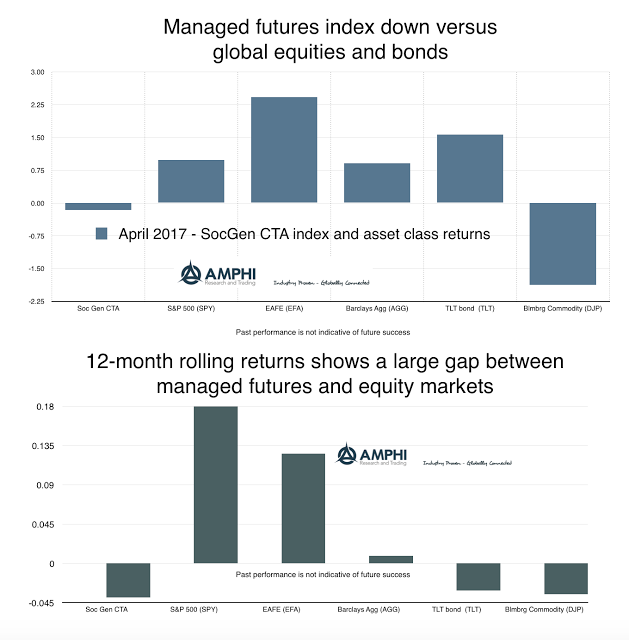

Managed Futures Flat for Month of April

The SocGen CTA index was essentially flat for the month which is not surprising given three major factors. One, we are in a global risk-on environment which generally is not attractive for trend-followers. It is not that there are no trends, but there were limited gains from diversification across asset classes relative to a risk-on portfolio. Two, there were few strong trends going into the beginning of the month. Given the usual time-frame for effective trend-following which is weeks not days, there has to be continuity of trends to have a good performance month. The strong gains in foreign markets may not have been given enough exposure to generate good portfolio returns. Three, the focus on financials especially fixed income and currencies by large managers was a drag on performance relative to equities and short commodities trends. Four, volatility is at extreme lows. We have looked at market volatility through the VIX index and current levels are above the 98th percentile for the lowest since 1990. Divergent strategies based on taking advantage of the spread in prices through time will be limited in their return potential in this type of environment.

Using Economic Growth as a Predictor for Managed Futures Returns

Another simple test to determine whether managed futures returns will do better than average is by looking at economic growth. We know that bonds and other defensive assets like managed futures will do better in “bad times,” such as a recession, but there are not many recessions. The cost of being defensive can be very […]

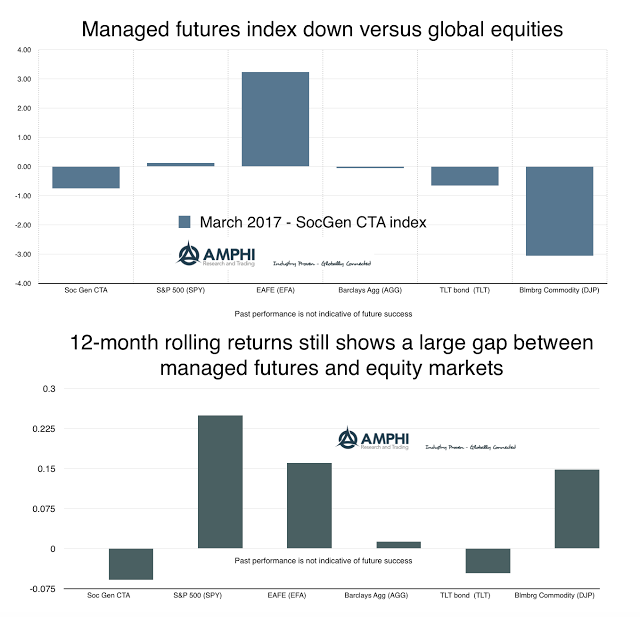

Managed Futures Cannot Find Returns on Market Reversals

Managed futures declined on market reveals from the Fed FOMC announcement of a 25 bps rate hike. While the move seemed to have been baked into market thinking before the announcement, key asset classes revised trend direction after the 15th. The SPX, which was already flattening in trend, turned lower. Bond returns, (long duration), actually turned higher on a perceived more aggressive Fed. The dollar strength reversed and commodities moved higher after declining for the last month. You get the picture on the change. Trend-followers saw a reversal in performance which added to a lower overall return.

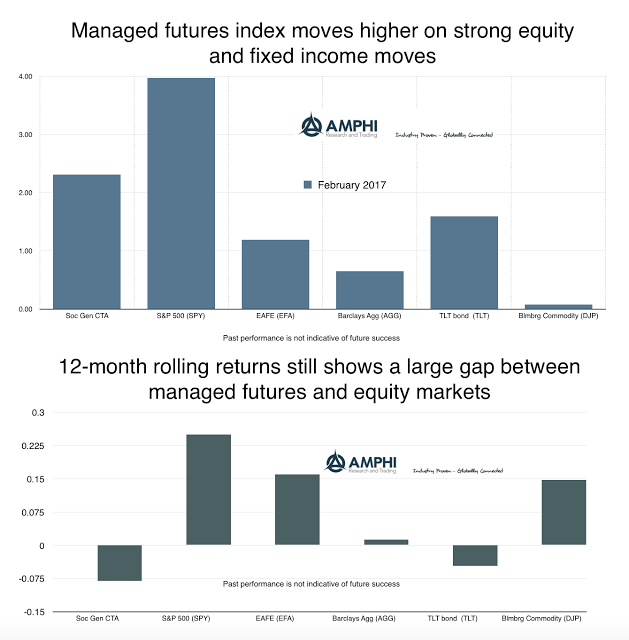

Managed Futures Show Strong Performance with Financial Trends

Managed futures strategies generally showed performance gains in February based on strong equity market return trends and the the positive gains in fixed income markets. The dollar also started to again trend up while commodities markets were more mixed. It is notable that there was a strong gap between traditional trend-followers and short-term traders whose index was down almost 2% for the month.

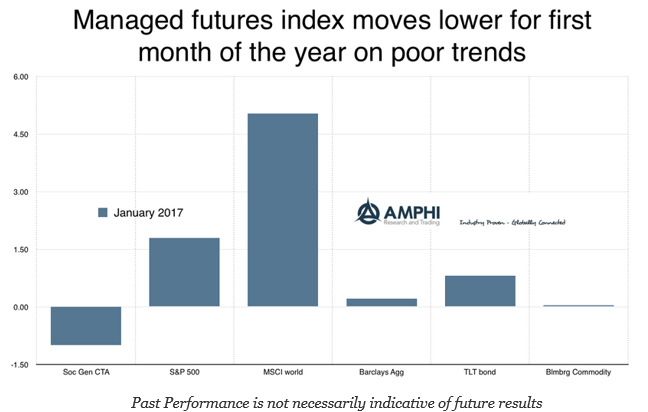

Managed Futures – No Trends to Exploit

The managed futures hedge fund style, as measured by the SocGen CTA index, declined by just under one percent for the month. There was limited movement in commodities and bonds and the largest gains for the month were in non-US equities where there is usually less exposure by futures managers. Going back over our sector trend measures, we were predicting a lackluster month since there were few strong directional trends going into January. The SocGen trend indicator index was down over 6 percent and the short-term trader index declined about 4 percent.

To Adjust or Not Adjust Volatility for Momentum Strategies

Risk management has taken the money management business by storm. If you run money, you have to say that you control volatility and manage the risk. It is the equivalent of saying, “I love my mother and apple pie.” If risk goes up, you have to cut position exposure or at least that is what many will say is the path to good returns. Nevertheless, the empirical testing of this truism could be improved. A recent paper in the Journal of Alternative Investments called, “Volatility Weighting Applied to Momentum Strategies” looks at this important question in detail and concludes that it does help at improving the return to risk.

Bond-Stock Correlation Should Be Driver of Managed Futures Decision

Why should I hold managed futures? This was a much harder question to answer when bonds had such a negative correlation with stocks. Bond provided safety, yield, and return. Allocations to bonds provided diversification and return during the post-Great Financial Crisis period. It protected portfolios when volatility spiked, generated returns during the falling inflation, and […]

Managed Futures – Should we be Disappointed?

Managed futures, as measured by the SocGen index, finished negative for the year. Many would have thought this was an odd 12-month return performance given the events of the year. Let’s list some of the big moves: the large equity decline in the first quarter, the equity gains in the fourth quarter, the bond gains and subsequent fall through the year, the dollar move higher, the BREXIT event, the US presidential election, and the comeback in oil to name a few. We could go on with some of the minor markets, but the overall conclusion is that there were trends and there were some large moves.

CTAs – What is going on with size?

CTA Intelligence reported the top 50 CTA’s as of September 2016 and provided some good graphics on the names and the changes over the last year. Taking a closer look at the data from the perspective of market structure and industrial organization provides some additional insights on the managed futures industry. We will focus the discussion on the top 50 managers because these are the ones that will receive the most interest from institutional investors. We can call this the relevant market.

Risk Hurdles

Risk management is more than applying quantitative tools to measure things like volatility or skew. It is an operational management problem of gathering and reporting data. The quality of risk management is related to the ability of a manager to properly aggregate data for analysis. Hence, strategies that have greater operational problems at gathering information on risk will have higher risk.