Today we are profiling a CTA that is new to the IASG database: Sandpiper Asset Management.

The Sandpiper Global Macro Program is a multi-strategy program employing systematic trend following and discretionary trading methods across 50 liquid futures markets. The Program produces returns across a wide range of economic cycles and exhibits a negligible correlation to other investable assets. Risk is managed systematically to a targeted annualized volatility. Today we welcome David Hathaway and Jon Farrin to take us through the details of their program.

- What is your core belief about the markets? Markets, at their core, remain the same over time and are ultimately driven by human nature. Price is the ultimate arbiter and at times it will move much further than people anticipate or think is possible. In other words, market prices are not normally distributed as most participant believe and this kurtosis leads to profitable trade opportunities.

- How does your system or trading method work and WHY? What is the theory behind it? We do not need the secrets, just the core principles. Additionally, markets behave in cycles driven by sentiment, fear, greed and various economic environments. This presents opportunities for different trading methodologies to work in certain cycles which is way diversification is key in asset allocations and is exactly why our Program employs a diverse set of trading methodologies.

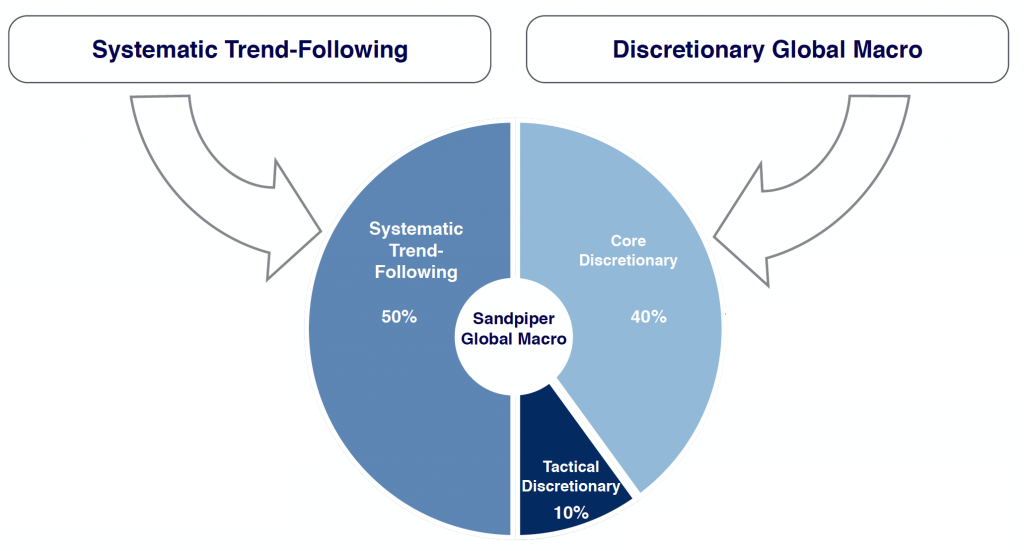

- How much of the decision-making is systematic, how much is discretionary? The Program splits its risk distribution equally and independently between systematic trend-following models and discretionary global macro. We do not take discretion over the models signals but inherent in every systematic approach is a level of discretion when deciding on parameters, optimization sets and execution implementation. It is here where our systematic models have an advantage of relying upon the talents of not only a system design expert but also a successful discretionary trader. The combination improves model performance outright but more importantly trading methodology diversification further ameliorates performance over all market cycles.

- Describe the role of each of the following types of analysis in your program: fundamental, technical, statistical, other. Systematic models are 100% price based and mathematically driven. Our discretionary approach is fluid given the type of market environment we are currently in and what approach makes the most sense at the time. That said, at its core it is fundamentally driven and technically implemented. In other words, the trade has to have a strong fundamental macro thesis but if it’s already priced in then it does not represent an attractive opportunity. Both approaches need to align to represent an attractive risk/reward proposition to take the risk.

- How many trades on average you do per month, not in RT/$1m but actual trades? Our systematic models trigger approximately 20 trades a month with an average winning duration of 100 days and an average losing duration 24 days. Core discretionary trades are put on a few times a month and average 3mths to 15mths in duration. Markets are constantly changing and therefore our discretionary strategies vary and tactical positions are taken through the month which are shorter term in nature. On average we put on 50 trades a month.

- Give 2 typical examples of your recent trades, win and loss. Over the course of 2015 Sandpiper benefited from the strengthening of the US Dollar relative to the G-10. Additionally, the profitable positions were levered significantly (with limited downside) in October by the use of very short dated options that led to windfall profits as the Dollar ‘broke out’ significantly during the period in which the options were held. Both technical and fundamental catalysts drove trade entries and positions were held for varying horizons, but each significantly profitable. The relentless move lower in government bond yields was a painful trade for Sandpiper in January of 2015. Central to the thesis behind the trade was that US growth would outstrip the rest of the world (which proved accurate) and that the continued decline in the unemployment rate nearing full employment would lead the Fed to signal to the market that they were moving towards normalizing policy. Unfortunately, the pull of disinflation around the world and the relative attractiveness of US yields to the G7 caused US yields to move sharply lower over the course of the month.

Edge

- Futures & Options trading is practically a zero-sum game. At the expense of what type of participants are you making money? What market inefficiency are you exploiting? Again, we take money from those that have to hedge at certain levels and those traders that act emotionally and irrationally over time.

- Who is your competition? The rest of the macro universe and alternative managers trying to produce uncorrelated absolute and risk adjusted returns.

- What makes you better than the competition, especially major financial institutions and funds with their extensive resources? In order to be a discretionary trader, you need to have a thorough understanding of your own strengths and weaknesses, errors that you’re prone to, etc. I tend to be incredibly introspective and have no ego when I’m trading. The market will tell you when you’re wrong, and it’s incredibly important to take heed when it does. Importantly, I tend to be a contrarian. When everyone believes something, I look for ways to lean the other way. Systematically we are able to be more nimble and take diversified idiosyncratic risk that our larger competitors can not do. We have less slippage to our model and better diversification. This is key…some people think trend following beta is easy to buy and thus should be free. However, if you look at the distribution of returns in the trend following community, it’s enormous. Often times in life, you get what you pay for.

- Do you think your strategy will always work or it may stop working at some point? Why? Markets will always yield opportunities, both on the long and short side. The Program’s discretionary strategy shouldn’t be beholden to certain market cycles or economic environments. While systematic trend following does work in cycles, the fact remains it works in the long run and always will as participants make behaviorally irrational trading decisions. The key is having the diversification to perform in all environments.

Performance and Risk Management

- How long have you traded your current strategy/method? I started building my own systematic models out of college in 2001. I took a class taught by legendary trader Jerry Parker and he ultimately inspired me to build my own models. I went on to found systematic interest rate trading at Wachovia/Wells Fargo in 2007 and continued after launching Sandpiper in 2012. Thematically the models have not changed since 2001, they seek to exploit undervalued kurtotis buy synthetically buying optionality. However, parameter sets have been improved and execution and risk management has been dramatically improved at Sandpiper.

- Your historical min/max/average gain and loss per trade in %. And in duration. Systematic trades have a 3.1 profit to loss ratio on average and 40 bps of risk is taken on every trade. Discretionary trades risk between 20-150bps depending on the level of conviction of the specific trade. Hard stops are always in place and trades are always taken with an asymmetric risk/reward profile.

- Identify the best and the worst periods in your track record and explain why they happened….understanding the good periods is just as important as understanding the bad ones. Ironically and in hindsight, fortunately, our worst drawdown was our first 5 months of trading. October and November of 2012 in particular were extremely difficult months for systematic methods and we were not immune. While our beta to systematic trading is negligible (.4), we do intentionally have it. Also truthfully, there was a bit of learning curve for our discretionary strategies. The implicit, added pressure of managing family/friends, vs trading at banks/hedge funds, required an adjustment period in order to overcome the ‘fear of losing’ that was felt initially.

- What kind of performance should be expected from your program? Volatility? Normal intramonth draw-downs? Maximum drawdowns both in % and length? Maximum positive and negative day, month, year? By design, we embrace upside volatility and our Program is designed to maximize profits while protecting downside and risk of loss as much as possible. The Program’s systematic risk management process is designed around at 15% targeted annualized volatility. However, upside volatility can skew this mathematically. We currently run an 8% annualized downside volatility which we believe much better represents our risk of loss to our investors. Drawdowns intramonth generally come after long periods of generating profits and at times and turn quickly, method diversification can help assuage these “give back” periods but it’s not impossible to suffer a 20% intramonth drawdown if you invest at our intramonth peak.

- What kind of performance would you be surprised by, both positive and negative? Our risk rules are systematic and strict by design. Everything we trade is liquid and can be exited immediately. I’d be surprised if we lost more than 10% in a given month and if we made over 30% net. September 2014 we generated 24% net driven off the back of large cheap synthetic options we purchased, this didn’t represent outside downside risk to our investors but using volatility to leverage an idea that you get right, is our exact strategy.

- What kind of draw-down would indicate that your approach/system had stopped working? Over the 30yr+ backtest, the largest drawdown was 24% and the next 2 largest were 20%… a drawdown larger and statistically significant would cause me concern.

- What are your risk-management tools? Which one is the most important? Multiple proprietary models run daily on both single asset, sector and at the portfolio level, to ensure target annual volatility is maintained. ALL trading methods employ strict adherence to predetermined trade limits in addition to sector concentration limits.

- Do you use stops? How do you use them? Do you have max loss per trade/day/month? Pre-incorporated stop loss levels are enforced on every trade. Additionally, risk is systematically reduced during drawdowns, reducing both outstanding positions and new positions going forward. This is designed to maintain an asymmetric return bias.

- What type of situation or event would be a “black swan” event for your program? Generally speaking our program is designed to specifically profit from “black swan” events…that said, we are at risk to a flash crash type event, as is everyone else taking risk in the markets. We aren’t at risk to counterparty or liquidity events, which is a further key to our strategy.

- What should prevent you from catastrophic losses? Being nimble, aware, liquid and absolutely systematic in our risk management procedures. Risk of loss is a fact of life in the markets but the risk of principal loss and being caught in a worthless position is extremely rare in the CTA world.

Background and experience.

- Where and from whom have you learned about the markets and trading? (spoke to this above when discussing Jerry Parker) Jon Farrin- After having worked on various trading floors and a hedge fund for the past 20 years, I’ve seen hundreds of different trading strategies/personalities, etc. I am also a voracious reader of market history, books etc. My favorite market book is Reminisces of a Stock Operator. Most importantly the market has taught me many valuable lessons over the past 20 years.

- What were your previous places of work? In what capacity? (David above) Jon Farrin- I ran the interest rate derivatives trading business at Wachovia/Wells Fargo where I worked from 1997-2010. I then was a global macro PM at SAC Capital before launching Sandpiper in 2012.

- Why did you stop working there? I left Wells Fargo because I wanted to trade at a hedge fund. I left SAC because I didn’t enjoy the culture and I wanted to run my own trading business.

- Why did you launch a CTA? There is no greater challenge than running a portfolio, where your results are published in real time. The black and white nature of it is why I’ve always loved trading/investing.

- What is your goal in life? To continue to run and grow our business into an industry leader, by virtue of our superior uncorrelated performance. And also to live a happily, balanced life, with plenty of time for family, exercise, and travel.

- Why do you trade? There is no greater intellectual challenge than trying to solve the never-ending, and constantly evolving, global markets. The feeling when you get something right, is a great thrill.

- When or why would you stop? I will never stop trading/investing…the best part is that it’s something you can perform at a high level as long as you live.

- Do people, making trading decisions, have their own money in the strategy? Are their funds traded together with clients’? The managing partners currently represent 22% of total AUM which we believe is crucial to keeping our interests perfectly aligned with our investors

A special thanks to both David and Jon for going through the details of their program with us today. Another important detail…Sandpiper was recently recognized by their peers to win a coveted CTA Intelligence manager award.