Category: Global Macro

Decoding Metals Price Action

Markets often communicate more clearly through price action than through headlines. The dramatic surge in metals contracts is sending a powerful signal, but what exactly is it telling us? Traders frequently monitor inter-market relationships for early warnings. When one asset class moves unusually, it can ripple across the system or reveal deeper structural issues. In […]

2025 in Review: Markets, Policy, and the Path Forward

History never repeats itself, but it often rhymes. This is even more so the case this year, as Trump began his second term with similar but different disruptions to the markets. Rising stocks, normalizing inflation, and the AI boom took center stage. We discuss some of the key events below and try to anticipate where […]

The Bankruptcy Cycle Returns: Delayed Failures and the Cost of Easy Money

Proper forest management requires clearing dead brush, protecting high-risk areas, and conducting controlled burns. As January 2026 approaches, marking the one-year anniversary of the devastating Southern California wildfires that destroyed over 16,000 structures, we examine the mistakes made and how those lessons apply to the financial markets. Much like forest fires, risk can be mitigated […]

How Irrational Is It? Valuation Ratios and Bubble Risk

For anyone who has ever ridden a roller coaster, the distinct sound of the chain nearing the top of the first drop echoes in our ears. Click, click, (slower) click…. Anticipation builds right before we experience the massive first drop, picking up speed on the way down. If only the equity markets provided the same […]

Gold’s Resurgence: Can Crypto Really Replace the Yellow Metal?

Once left for dead, gold speculators can sleep easily in 2025 as the yellow metal sits at all-time highs once again. Despite the shift to Bitcoin and other digital assets, the enduring nature of gold as an inflation hedge continues. What is driving this surge, and will cryptocurrencies still win the battle? Reasons for optimism […]

Is the Fed Late—Again?

After months of telling the public that “Inflation is transitory,” the Fed finally admitted that it kept policy loose for too long in 2021. Months of rate hikes followed in 2022, dragging the stock market down as assets repriced. Now, the rates in the United States outpace those of major economic zones across the world. […]

Paradigm or Paradox? When Tariffs Replace Free Trade

Politicians like to pick and choose their economic schools of thought to justify their policy and spending decisions. Elected liberals like to point to the Keynesian effects of government spending, whereby each dollar inserted into the economy drives multiples of that value in growth. Conservative officials often use the Austrian theories, which posit that free […]

A Bull in the China Shop

A common complaint about politicians is that they avoid critical decisions because they only care about keeping their job. Much like a middle manager at a bank, taking a daring chance and failing gets you fired, but doing the bare minimum keeps you employed. Donald Trump is not a normal politician. In a continuing trend, […]

Breakout Funds – Interesting days ahead

What a wild past 27 hours across Macro. Yesterday was one of the most anticipated Fed meetings in memory. Markets were looking for a cut of 25 and hoping for more – either yesterday or in the near future. What we got was 25 and a bumbling press conference where Powell seemed to have no clue what was driving Fed policy at this point. The best we could take away was further trade uncertainty may result in those much begged for rate cuts. But this was just a guess, and that’s the point.

Trading Palladium: A Classic Macro Approach

Disclaimer: While investment in managed futures can help enhance returns and reduce risk, it can also do just the opposite and, in fact, result in further losses in a portfolio. In addition, studies conducted on managed futures as a whole may not be indicative of the performance of any individual CTA. The results of studies […]

Diverse ARP return pattern consistent with macro environment

A comparison of ARPs across asset classes and styles from the HFR indices shows consistency with the macro environment. We equalized the HFR ARP indices to a ten percent volatility for ease of discussion. April monthly returns are in grey while year to date returns are in red. The returns were generally lower than the market exposures, which were expected. The HFR numbers are averages and have shown significant dispersion. The low correlation across ARPs will create opportunities to improve the return to risk ratios through portfolio blending.

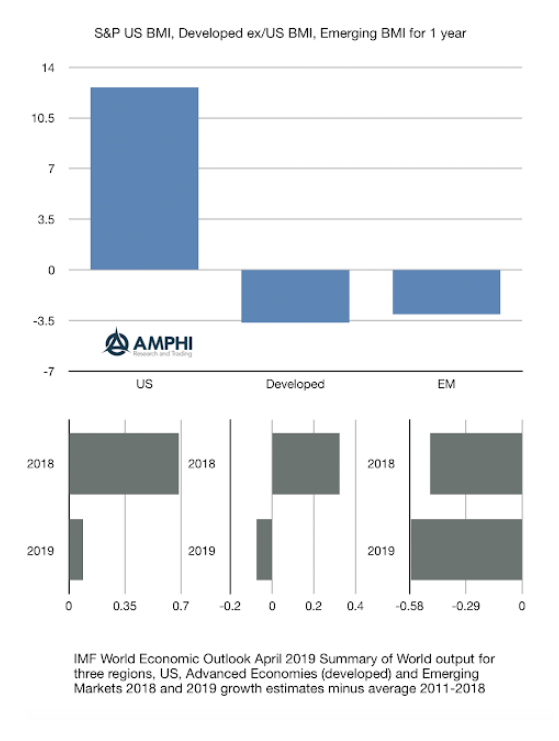

Global Macro Rationality and Equity Returns – Consistent With Growth Story

While some question the rationality of markets over the last few quarters, we believe equity markets are global macro consistent. This consistency can be seen in the return pattern for the US, developed markets, and emerging markets. As a simple surprise number, looked at the difference between the average growth rates for three macro categories from the IMF WEO from 2011-2018 against 2018 growth and expected 2019 growth.

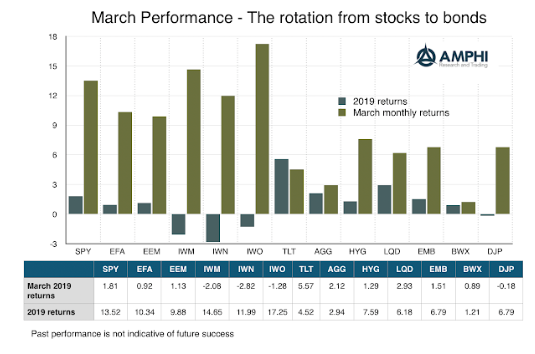

March – The big rotation from stocks to bonds

March was about asset class rotation from equity to bond demand with fixed income significantly out performing equities in March. Markets have moved from the January monetary euphoria to something more cautious and questioning. If the Fed potentially put all rate rises on hold for 2019 and the ECB is delaying a course on normalization, do they know something I don’t know?