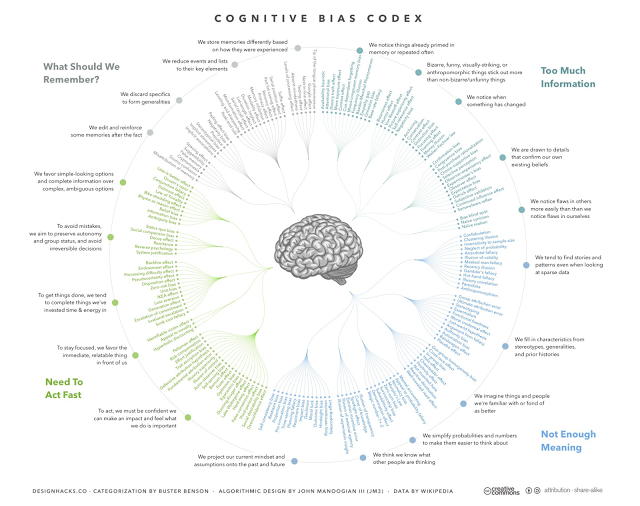

The list of cognitive biases that can affect investors keeps growing. An explosion of studies show that observed decision-making under real and test conditions is hard. Just look at the wheel from Buster Bensen’s cognitive bias cheat sheet, the single best graphic I have seen which lists and categorizes the cognitive biases investors face, to get a flavor of the problem. Nevertheless, this work does a good job of reducing all of these biases into four problem categories:

- What do you do with too much information?

- How do you find meaning within all of this information?

- How do you act quickly given this overload of information?

- What should you remember to make sure you minimize mistakes?

We generate rules or heuristics to solve these four problems, but shortcuts may generate decision biases. We may be able to make fast decisions, but that does not mean that these choices are good or the best decisions. Solving problems using rules of thumb create biases which means that investors may leave money on the table and mistakes will be made. Performance may suffer and markets are less efficient.

These biases may not always be flaws but rather attempt to solve core problems of information overload. The biases may result in failures in thinking, but problems of information overload and making fast decisions are still real and have to be addressed. The issue with the behavioral finance work is that the number of biases just keep getting larger, yet there seems to be a shortage of answers of how to address these biases in order to minimize mistakes. Our ability to break-away from these biases has not match the growing problem list. We can agree that human decision-making is flawed, but what comes next?

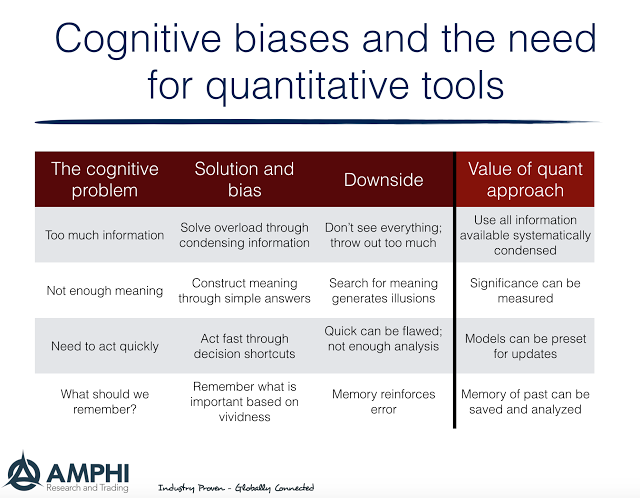

I think the question of dealing with behavior biases can be answered. It just has not been directly addressed as a core solution. The four problems with information overload and cognitive biases can be solved through embracing quantitative tools.

- If there is too much information, then use statistics which at its core reduces the need for all information. The focus of statistics is associated with condensing information through finding key measures and reliable relationships.

- If there is too little meaning in the information, quantitative tools can be used to find significance. Data that are not meaningful are not used.

- If there is a need to act quickly, models can be pre-loaded and easily updated to provide new one-step ahead forecasts. Bayesian statistics can be used to update information in a systematic fashion.

- Finally, quantitative tools can be used to provide useful memory. Relationships from the past can be stored and change sin those relationships can be measured objectively.

Quantitative tools can be employed to eliminate specific biases for problems that are repeatable and structured as often found in trading. There may be biases with any quant model, but the biases and errors can be measured and followed. How deeply quantitative tools are embraced is a matter of preferences, but the solutions to cognitive biases are right in front of us if we structure the information problems properly.