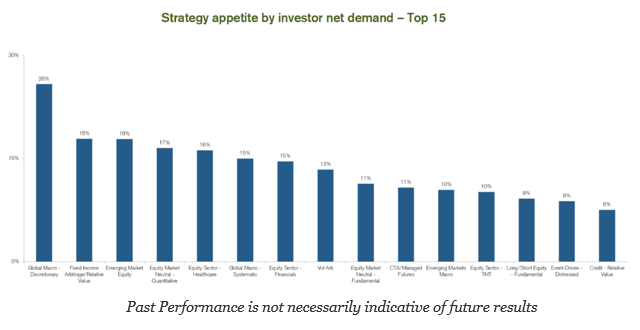

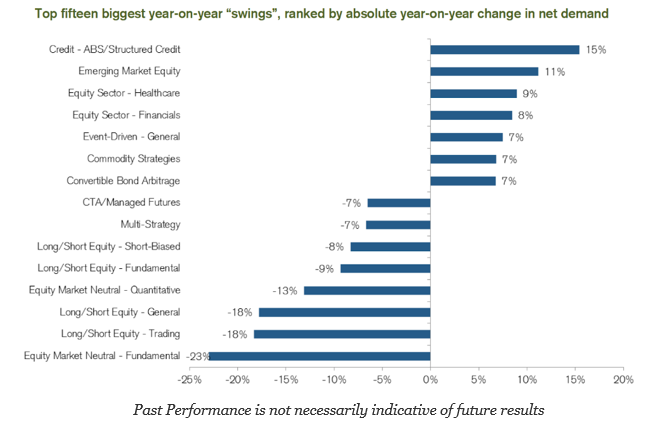

The latest Credit Suisse hedge fund survey for 2017 provides a detailed review of where there is the most investor demand for hedge fund strategies. Number one is global macro based on a desire to have greater portfolio diversification. This appetite is followed by fixed income arbitrage. The swing in demand shows a movement away from long-short equity and a movement to credit and sector specific strategies.

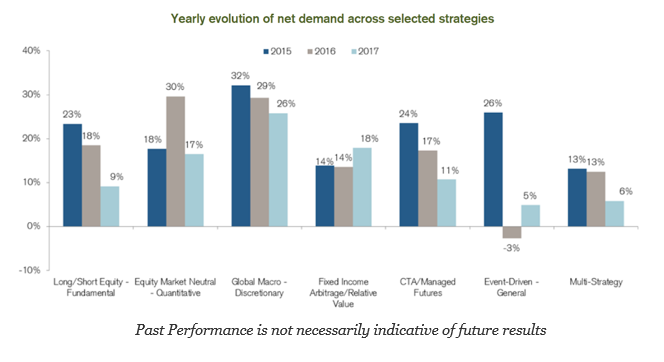

Nevertheless, there has been a decline in net demand across many strategies with strong declines in discretionary global macro and managed futures. Hedge fund investors are being more selective with their demand as opposed to a general increase across a number of strategies.

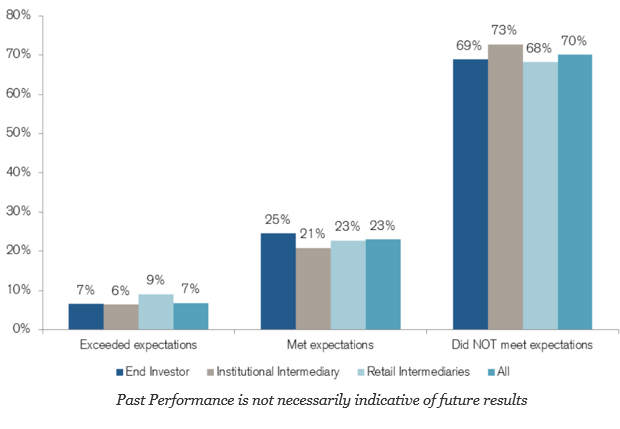

A consistent theme across many of these hedge fund investor surveys is the disappointment with hedge fund performance. Well over 2/3rd of investors believe that hedge funds did not meet expectations. It is odd that investor demand is still strong for hedge funds even though they do not think hedge funds are doing their jobs. This is not a good statement on the quality of the industry.

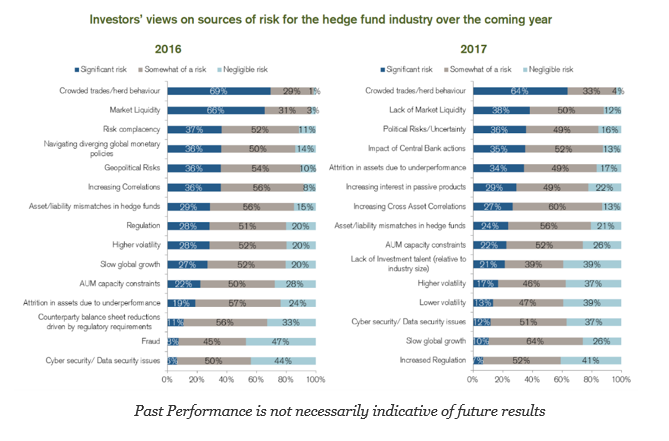

I found the most interesting survey table the sources of risk for the coming year. Number one and two for the second year in a row are the same; crowded trades and market liquidity. These risks are very difficult to measure, yet these uncertainties seem to be the chief concern of investors.

The CS survey confirms many of the conclusions of other surveys. There are differences, but what seems to be unmistakable is that managers have disappointed investors and have not been able to provide them what they want. Investors are looking for diversification and returns that can meet expectations. It is the job of managers to control expectations by generating returns that are consistent with what has been marketed. It is also the job of managers to offer a different return stream that is independent of traditional asset class beta. The difference between what investors want and what managers provide has to be closed.