Behind the backdrop of the vast changes in monetary policy over the post Financial Crisis period has been the movement to improve the regulatory environment for financial markets in order to reduce systemic risk. Significant work has been done to improve monitoring and rules to eliminate excessive speculative behavior, but as more regulations are proposed and more changes to the financial system are made, there is demising marginal benefit and a greater likelihood for unintended consequences. A rule that makes sense for one group may lead to a shift in risk capital and changes in behavior toward unregulated areas. Simply put, risky behavior will shift to the places where the cost of speculative behavior is least.

Money and credit will always seek the lowest cost environment. The micro dynamics of markets where there are different players seeking to reach various objectives is all the more critical when thinking about crises, liquidity, regulation, and pricing. The microstructure of markets matters and the behavior of players toward changes in the “rules of the game” is important. In an older school of thought, this would be called market structure or industrial organization. In the current environment, we can relate this market networks.

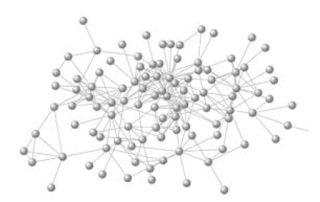

Given a focus on the financial behavior of agents, there has been more research on the interaction or connectedness of players within the financial environment. The economics of networks is an important advancement on our thinking of markets work and how market agents or players interact to changes in the environment.

If you believe that markets are efficient, then the behavior of players in a network may not matter. If you believe information comes from disparate sources both exogenous (from economic policy announcements and data releases) and endogenous (based on the players in the market, hedgers or speculators), then the network and connectedness of player matter. More importantly, if the costs for trading change for agents in the network, the connectedness of players will change. The efficiency of the market is based on the interaction of dealers, traders, and hedgers.

The network approach will suggest that regulations that change the cost of trading or place restrictions on traders will impact the efficiency of markets. If the cost of trading is higher, arbitrage may be more expensive and there will be more market frictions. Price relationships will change with the relative expenses of trading.

A network view of market behavior will focus on structural changes that will affect the flows of information and capital through the network. Systemic risks will change with the blending of the network. The systematic risks of yesterday will be different today when you change the costs to players in the network. Follow the transaction, regulatory, and capital costs to determine the changes of risks within the network. Then follow the money through the network. The simple answer is that the systematic risks today will be different than from 2008 because the network of trading has changed.