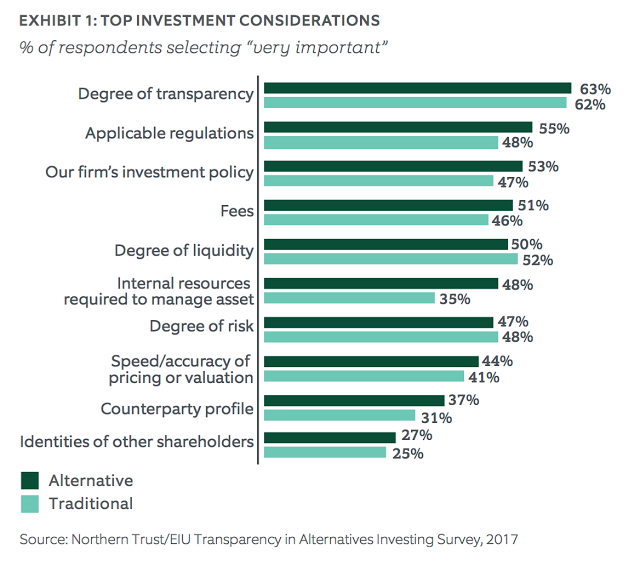

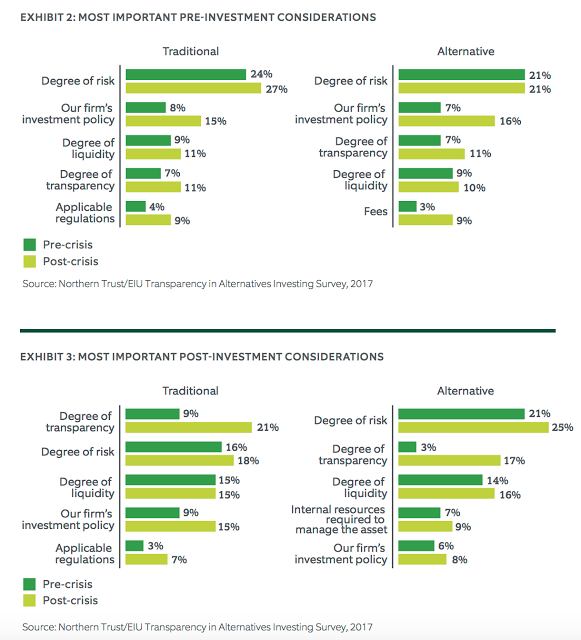

The Northern Trust/EIU Transparency in Alternatives Investing Survey 2017 focuses on some important investment considerations from investors around the world. Once again the most important issue seems to be the degree of transparency provided by managers. This applies to both traditional and alternative managers. An investor needs to know what he is buying when he gives money to a manager. Funds are entrusted to others. The purpose for this transparency is very clear – understanding the degree of risk being taken.

Transparency on a simple level means information. Investors want to know the contents of the portfolio and the foundation of the investment process or style, but the degree of risk is more complex issue. You may have the information, but you may not know the actual risks within the portfolio. The true demand of investors is with interpreting the data. What are types of risk being taken? What are the risk premiums being exploited? How will the portfolio react to changes in the investment environment? Transparency is more than information but clarity with the expected behavior of the manager and the types of risks hidden when securities are aggregated in a portfolio.