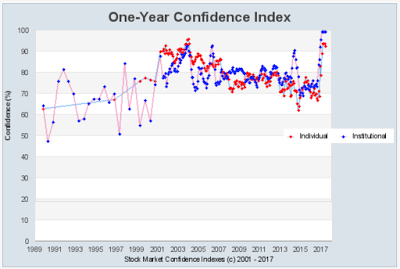

The Yale International Center for Finance conducts monthly surveys of individual and institutional investor’s confidence in the stock market. While there are other surveys available, the Yale Center provides a long term view of what investors may think about the markets.

The explosion of confidence by both individuals and institutions is off the charts both for the level and acceleration. The numbers cannot get much higher. Of course, this will be food for contrarians, but only because confidence as only one direction to go now. The confidence index is a trend that should not be fought by investors. With this confidence comes new money and less willingness to sell on any minor reversal. Nevertheless, when there is such acceleration in confidence there usually is fast reversals. The link between these reversals and market action is somewhat mixed.

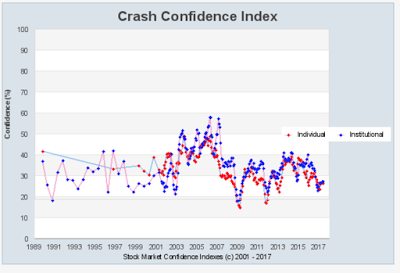

Crash confidence has fallen over the longer-term (last three years) but it has also started to trend higher in the last three months. Clearly, there are a growing number of investors who are not convinced that this is a one-way market. Unfortunately the crash confidence measures a strong single day type move and not a slower trend lower.

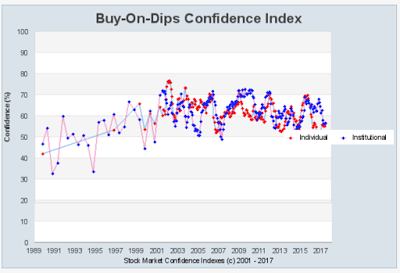

Perhaps a concern is that the buy-on-dips index is moving lower, Everyone is confident that the markets will be higher, but there is less willingness to put new money in the market if there is a retracement.

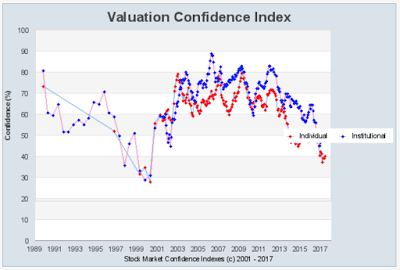

As surprising as the upside confidence levels, there now a large decline in valuation confidence. This survey tells us the percentage of the population that thinks the stock market is not too high. Clearly, we are now seeing confidence that the market will go higher over the next year but valuations that are extended. We are at valuation confidence views that are lower than 2007-2008 and closer to early 2000’s.

There are feedback loops between survey views and market action. Confidence can sometimes be a leader while other times be a follower; however, anytime there is an extreme, there is an opportunity for large market divergences. Divergence or turbulence will lead to rebalancing flows which means extended trends which can be exploited.