How often are we going to hear about the overvaluation in equity markets? It already seems too much, yet talk is cheap because markets continue to trend higher. The focus should be on what events will cause this trend to reverse; nevertheless, a trend in place will stay in place until there is a reason to change. Unfortunately, a change in a trend usually comes from a surprise.

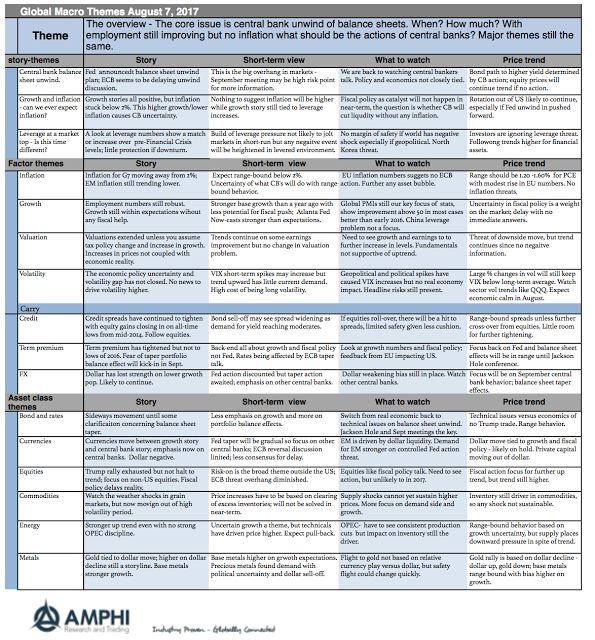

We have not adjusted significantly the story-themes from last month. In fact, themes usually last for months, so this is not unusual. There are only two major themes that should be the focus of investors. One, the timing for when the Fed will start the balance sheet tapering. The market has been given details. The Fed wants investors to prepare for it. Unfortunately, many investors have not focused on these details and the implications of balance sheet reversals. As these implications sinks into investor expectations, we expect a change in risk sentiment. Two, the current leverage around the world cannot be sustained. Many economies are at or above Financial Crisis levels. Of course, the ability to pay for this debt is stronger given the low interest rates, but the current rate environment cannot give any further market relief. There will a catalyst for a deleveraging event, and when that happens, asset prices will reverse.

We expect that balance sheet tapering may be the catalyst for a deleveraging event. This is not an August event, but more likely to come to a head during fall central bank meetings.