If you wanted to focus on three longer-term macro factors that will drive overall commodity prices, it will be global growth, the dollar, and liquidity. The determination of long-only allocations in any asset allocation should focus on these three. Trading issues will be driven by volatility and market shocks.

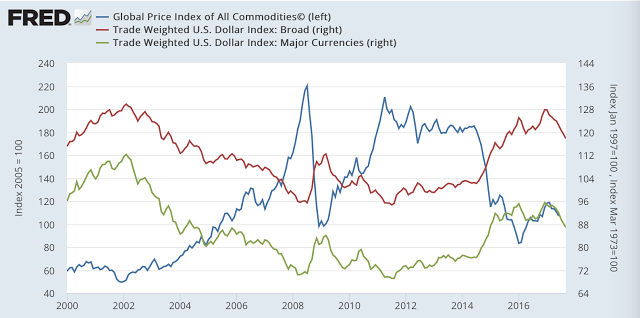

Growth impacts demand, the dollar level will impact the market-clearing price since so many commodities are priced in dollar, and liquidity will impact investments and speculative flows.

If growth globally, increases, demand for raw materials like metals and oil will increase with the unanticipated portion of growth. The price elasticity will change with the level of inventory. As excess inventories come down and production tightens, growth shocks will be more significant. As the dollar goes up, the cost paid for any dollar denominated commodity will also go up. The supply side will often be determined by production shocks which by their very nature will be surprises, but liquidity will impact supply through financing. New investment, the cost of holding inventory, and demand will be affected by the price of liquidity/credit.

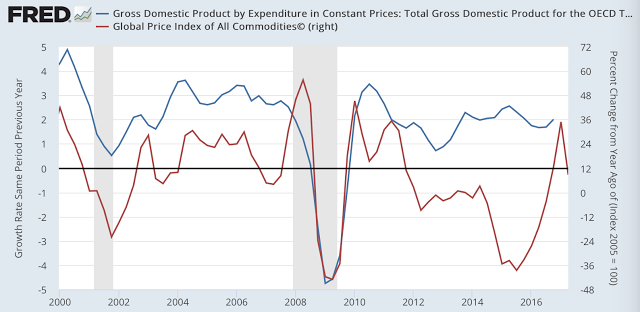

So what do you need to know for general commodity price movements? There is a positive relationship between growth and commodities, especially base metals and oil prices. Hence, more growth should be commodity positive. A falling dollar will be commodity positive by reducing cost of purchasing the commodity. Finally, the real rate of interest will impact investment decisions.

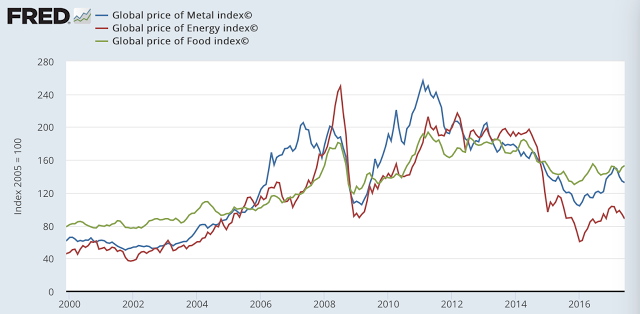

So what are the cross-currents for commodities today? First, there is growing dispersion across commodity prices. The one factor world of a global growth slowdown and then pick-up is over with energy prices separating from metals and food. The impact is that there is more intra-sector diversification benefit from commodities and an increase in value from skill investing. We expect this trend to continue.

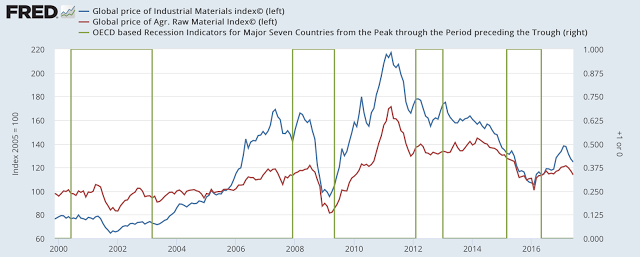

The tight correlation between global commodity prices has fallen with the stabilization of global growth. The lead-lag relationship between growth and prices does change over time with the more recent surge in global prices preceding the pick-up in 2017 growth. Looking at OECD recession indicators suggests that commodity prices will weaken when recession indicators are heightened. Currently, there are no heightened indicators of global recession.

The long slide in the dollar matched the rise in commodity prices and the dollar gains over the last few years were matched by declines in commodity prices. The current dollar decline while significant over the short-run has a long way to go to match the lows in the dollar during the post-financial crisis period. Nevertheless, if the dollar slide continues, we will see increased commodity demand.

The extended period of low real rates has meant that liquidity changes have not been a significant driver in commodity trends. While the Fed is raising rates, other central banks have continued to follow loose monetary policies that have made liquidity a non-issue in commodities at this time.

Given these relationships, we are positive on asset allocations to commodity opportunities. This may not come in the form of the traditional commodity indices but holding commodities as a diversifier and return generator has more forward-looking benefit.