Regardless of the speculative warnings or the beware signs in fundamentals equity markets continue to move higher. Who says there isn’t inflation? It is just a matter of definition between real goods and financial goods.

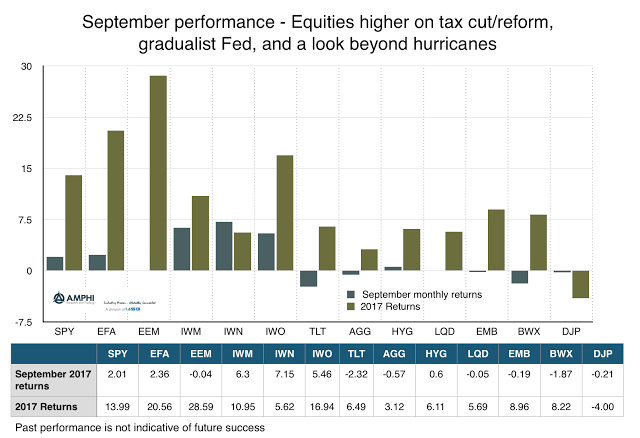

This month small cap, value, and growth benchmarks led sector returns as plans and talk of tax reform and/or cuts are back on the table. The continued cautious Fed announced their balance sheet normalization plans which will start next month, but it will take years before there is a real serious dent in the Fed’s balance sheet. Nonetheless, other central banks continue to expand their balance sheets and provide liquidity. The Fed also engaged in further talk of gradualism since inflation continues to fall below the 2% target. Without a negative catalyst and no binding constraint on credit, the markets move higher.

Bonds posted negative returns on asset class switching and the uncertainty concerning inflation. With Fed chairman Yellen speaking about the “mystery” of inflation, there is more bond uncertainty. Bond risk premiums, which include inflation uncertainty, have been squeezed to zero, so anything that causes market confusion on the link between Fed policy and rates will boost that premium and be bad for bonds.

International investments were mixed based on the strength on the dollar. Clearly, the stronger relative performance of US assets was from greater sensitivity to fiscal tax policy and a focus beyond the economic noise from hurricanes.

When markets do not behave in ways consistent with fundamentals there are only two options, avoid the game and focus on risk conservation, or follow trends under the simple view that price action is a better barometer of market opinion. Whether the story for equity strength continues is not clear; however, the cost of risk avoidance has been high in 2017.