A recurring global macro theme has been how investors should think about stock bond correlation. The negative correlation between stocks and bonds has been the single best diversification provider for any portfolio. There are very few alternative investments that have offered the same amount of diversification and provided a significant amount of alpha. This simple diversification is why variations on the 60/40 stock/bond portfolio mix have been such winners since the Financial Crisis. But times change, or more specifically, regimes change.

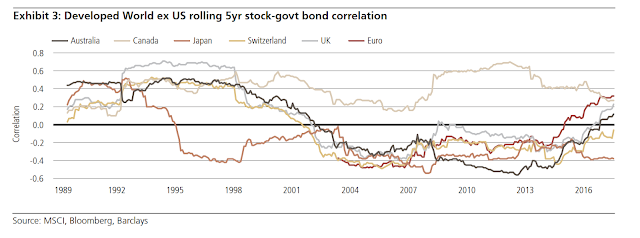

A UBS Asset Management piece “Investment Troubles” suggests that the stock/bond correlation is loosely tied to inflation regimes. The negative correlation of today has not been a given through history and an often overlooked fact is that the negative stock/bond correlation seen in the US is not a given in other countries. For example, the US stock/bond correlations in the 70’s, 80’s and 90’s were positive. Canada has seen positive correlation between stocks and bonds during the entire period when the US correlation has been negative. This asset class correlation is dynamic and situational.

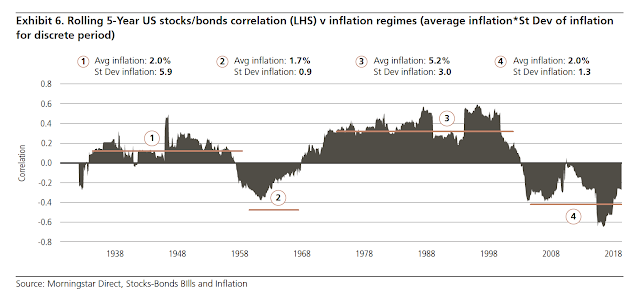

A long-term look at the US stock/bond correlation shows that there have been long period of both positive and negative correlation. These dynamics exist even though a good working hypothesis is that this correlation should be positive. A change in short-term interest rates should impact the valuations for stocks and bonds in the same direction through present valuing of cash flows. In reality, the key issue affecting correlation is the level and volatility of inflation.

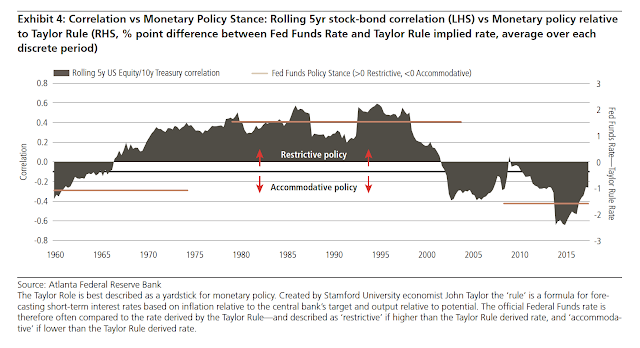

When inflation is high, the short-term discounting factor which includes expected inflation seems to dominate the stock/bond correlation. When inflation is low and thus short rates are low, other factors such as economic growth seem to dominate and growth will have an negatively impact on the stock/bond correlation. A further review suggests that these inflation regimes will be associated with monetary policy.

The monetary regimes will respond to inflation and create a different correlation environment as measured by the Taylor Rule.

Extrapolating this historical information suggests that the combination of restrictive monetary policy in a higher volatility environment will tilt diversification risks to higher correlation. It is unlikely that there will be a significant inflation risk shift in the near-term, but our priors suggests that investors will not continue to receive the diversification tailwind that was the great portfolio risk reducer in the post Financial Crisis period.

Some past posts on the issue:

The stock-bond correlation curve – Risks from the Fed?

Yes, the stock-bond correlation is rising, but let’s have some perspective

What do you really get from bond diversification in the 60/40 blend?

Normalcy for stock bond correlation says you need other forms of diversification

The problem with a 60/40 asset allocation – correlation